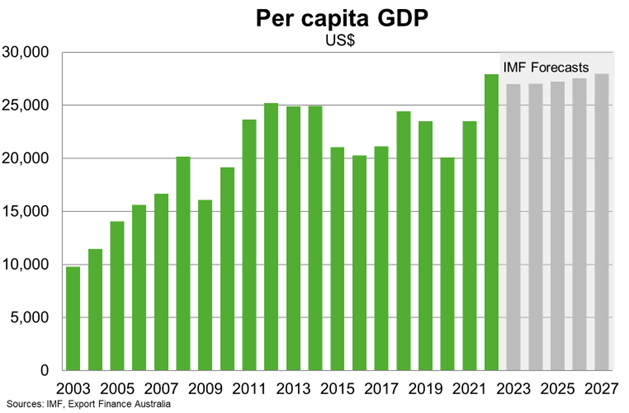

According to IMF estimates, GDP per capita is expected to remain stable at around US$27,000-28,000 over the next five years. Saudi Arabia benefits from strong oil-linked growth but suffers from substantial social inequality and relatively high youth unemployment.

Saudi Arabia

Saudi Arabia

Last updated: January 2023

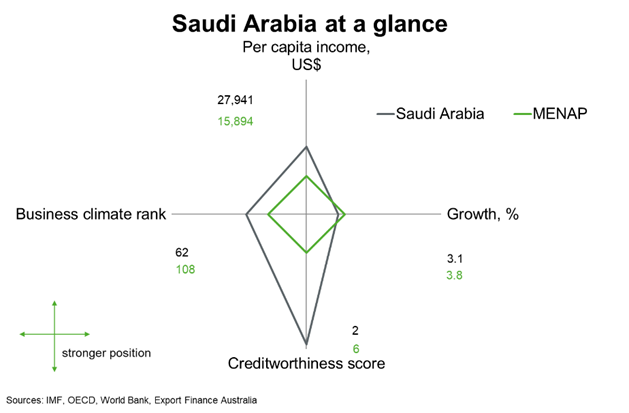

Saudi Arabia is the largest economy in the Middle East, North Africa and Pakistan (MENAP) region, and the world’s largest exporter of oil. Saudi Arabia outperforms most of the MENAP region on per capita income, creditworthiness and ease of doing business. The reliance on oil to drive output, jobs and fiscal and foreign-currency revenue leaves the country vulnerable to swings in oil production, demand and prices. Saudi Arabia remains committed to implementing reforms to diversify its economy away from oil through its Vision 2030 Program.

The above chart is a cobweb diagram showing how a country measures up on four important dimensions of economic performance—per capita income, annual GDP growth, business climate rank and creditworthiness. Per capita income is in current US dollars. Annual GDP growth is the five-year average forecast between 2023 and 2027. Business climate is measured by the World Bank’s 2019 Ease of Doing Business ranking of 190 countries. Creditworthiness attempts to measure a country's ability to honour its external debt obligations and is measured by its OECD country credit risk rating. The chart shows not only how a country performs on the four dimensions, but how it measures up against other countries in the region.

Economic outlook

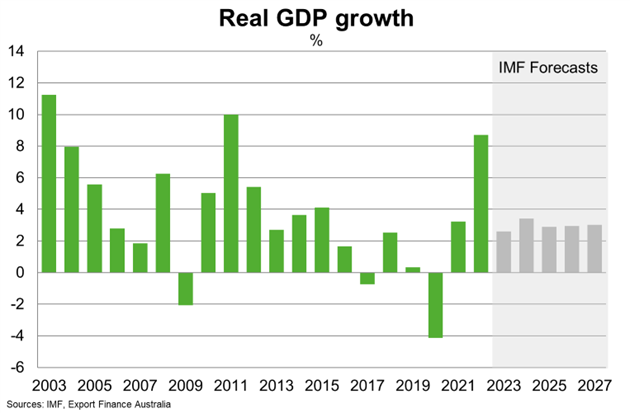

Growth in Saudi Arabia accelerated to 8.7% in 2022 from 3.2% in 2021, driven by higher oil prices and growing non-oil output. Higher oil prices and increased oil production have also strengthened fiscal and external accounts.

The IMF expects growth to moderate to 2.6% in 2023 before picking up to 3.4% in 2024. Growth will be led by stronger private consumption, an increase in tourism and higher domestic capital spending. Oil exports will slow due to restrictions on supply in the recent OPEC+ agreement.

Successful implementation of the National Investment Strategy and labour market reforms could boost the outlook. Downside risks include a sharper global economic downturn and potential oil price falls should OPEC+ raise production targets.

Saudi Arabia’s long-term outlook is strong. Public construction activity related to Vision 2030 development projects and recovering tourism supports growth in the non-oil sector. Vision 2030 aims to promote stronger FDI inflows and diversification into higher-value-added industries. The authorities have taken important steps to improve the regulatory and business climate, attract foreign investment and boost private sector participation in the economy. Maintaining long-term growth will rely on sustaining reform momentum. Regional geopolitical tensions and oil price volatility remain key downsides to the outlook.

Country risk

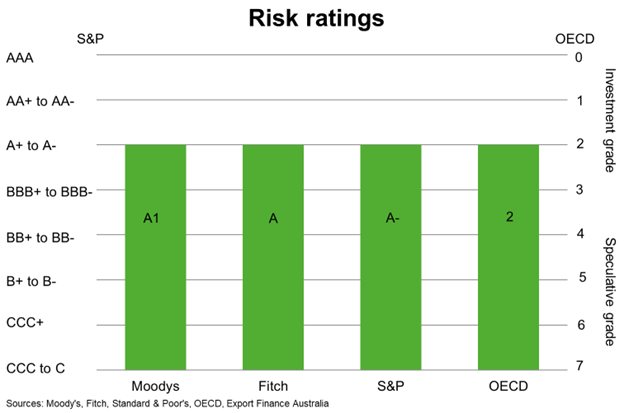

Country risk in Saudi Arabia is low. The OECD country risk rating is 2 and the country has investment grade ratings from all three major private rating agencies. This suggests that there is a low likelihood of the country being unable/unwilling to meet its external debt obligations.

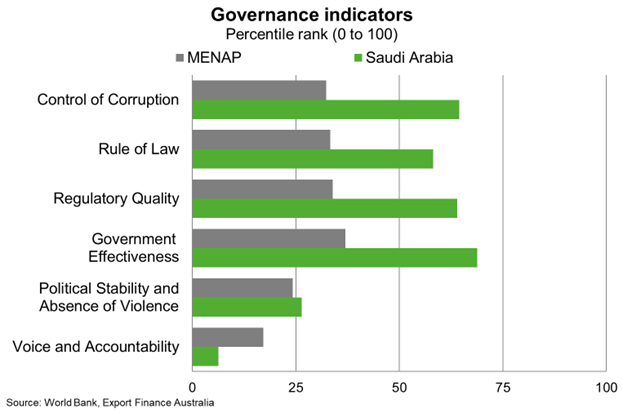

Saudi Arabia scores in the top half of most governance indicators and has a track record of solid fiscal and economic management. That said, Saudi Arabia scores lowly on measures of voice and accountability. The monarchy controls the government, and most laws are based on Islamic principles, often limiting freedom of expression.

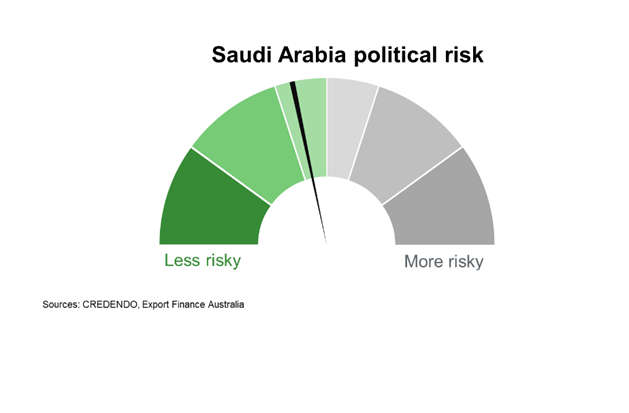

Political risk in Saudi Arabia is low to moderate and includes risks related to the escalation of regional geopolitical tensions that can hinder oil production and trade.

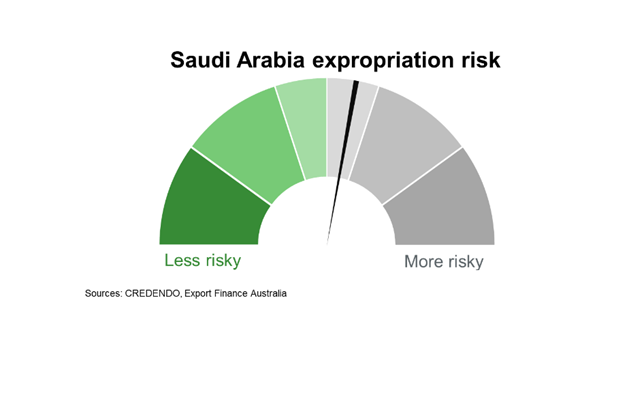

The risk of expropriation in Saudi Arabia is moderate. The US investment climate statements note that generally the Saudi Board of Grievances has jurisdiction over commercial disputes between the government and private contractors. The Board also reviews foreign awards and court decisions to ensure they comply with Sharia law. This review process can be lengthy, and outcomes are unpredictable. Further, some disputes are handled through intra-ministerial administrative bodies and processes in Saudi Arabia instead of a court. The US is not aware of any cases of foreign investor expropriation without adequate compensation, but some SMEs have had their investment licences cancelled without justification, causing them to forfeit their investments.

Bilateral relations

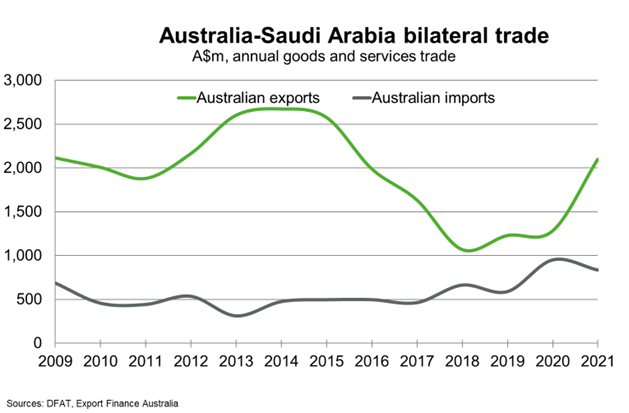

Saudi Arabia was Australia’s 32nd largest trading partner in 2021. Total goods and services trade amounted to $2.9 billion in 2021. Australia’s major exports to Saudi Arabia in 2021 included barley, education-related travel, and wheat. Major imports from Saudi Arabia included fertilisers, gold, and aluminium.

There is scope for Australian firms to boost agricultural exports to Saudi Arabia, particularly as the expanding middle class there starts to demand higher-quality proteins and grains. Opportunities also exist in the extractive industries, infrastructure and education and health.

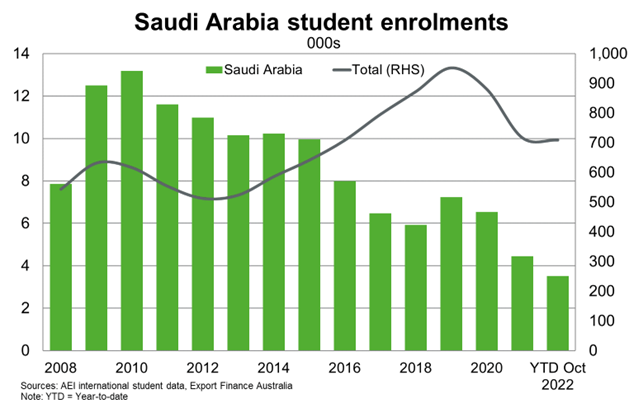

Education dominates Australia’s services exports to Saudi Arabia. Although enrolments in Australian educational institutions have been falling over the past ten years, Saudi students represent the largest cohort from the Middle East region. Saudi Arabia’s Vision 2030 program could provide opportunities for Australian institutions to provide education services in Saudi Arabia.

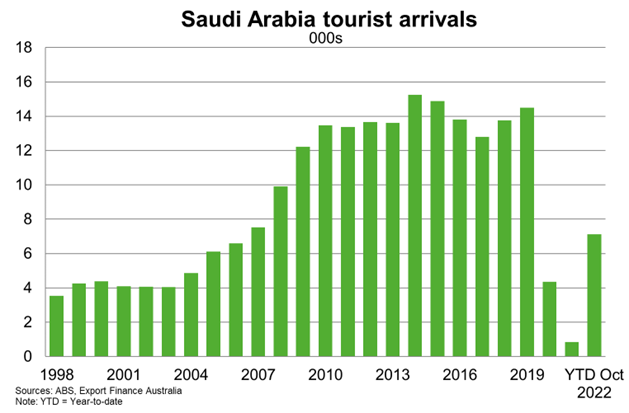

After a pandemic-induced slump in 2020 and 2021, tourist arrivals recovered in 2022 as international border restrictions eased. Another year of open international borders and pent-up demand for travel should support further recovery in tourism, and broader services exports, in 2023.

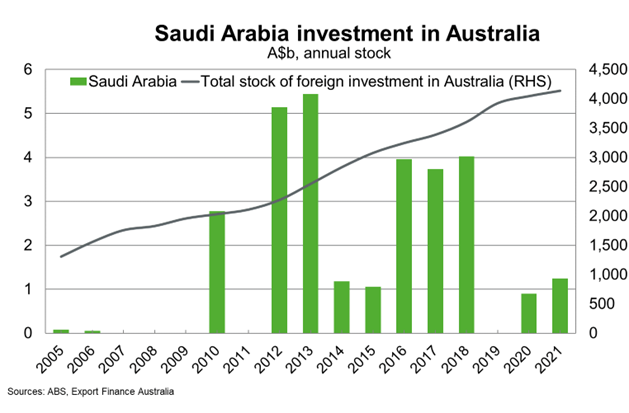

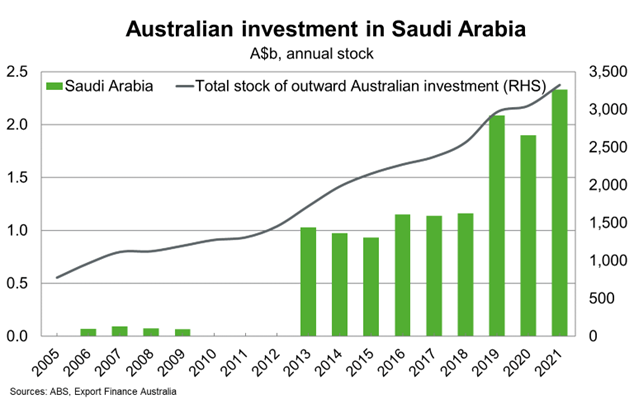

Bilateral investment between Saudi Arabia and Australia is modest. But investment opportunities are large, particularly in mining and agriculture. Major Saudi sovereign wealth funds are increasing their international investments, including in oil and gas assets and renewable technologies. The Saudi Agriculture and Livestock Investment Company invested in Australian agricultural land in 2019 and is exploring further agriculture investment options.

Useful links

Department of Foreign Affairs and Trade

Austrade