Nepal—Political volatility undermines economic prospects

Prime Minister Khadga Prasad Sharma Oli dissolved Parliament and called early elections in Nepal in December. On February 23, the Supreme Court overturned that decision and parliament has since resumed. However, the governing coalition Nepal Communist Party has split into pro- and anti-Oli blocs in the wake of the controversial dissolution. Neither side appear able to prove a simple majority. As such, engaging with opposition parties will be key to ending the impasse. An imminent confidence vote is unlikely given that Oli’s opponents must agree on who should replace him and make sure they have the numbers to win. Under Nepal’s constitution, a no-confidence motion can only be tabled if an alternative Prime Minister is proposed, and if it fails, another attempt can’t be made for a year. Intra-governmental tensions and factionalism are therefore likely to worsen in the near term, challenging governability and causing policy paralysis.

Nepal is among the least developed countries in the world, with 25% of its population living below the poverty line. A cornerstone of the government’s reform agenda is strengthening the investment climate. In particular, Nepal has considerable scope to exploit its enormous hydropower potential. However, the difficult business climate has hampered foreign investment despite numerous trade and investment agreements. FDI averaged just US$120 million p.a. in the five years prior to the pandemic and Nepal ranked 108 of 141 economies in the 2019 Global Competitiveness Index. The ongoing political imbroglio will further weigh on investor sentiment and economic prospects.

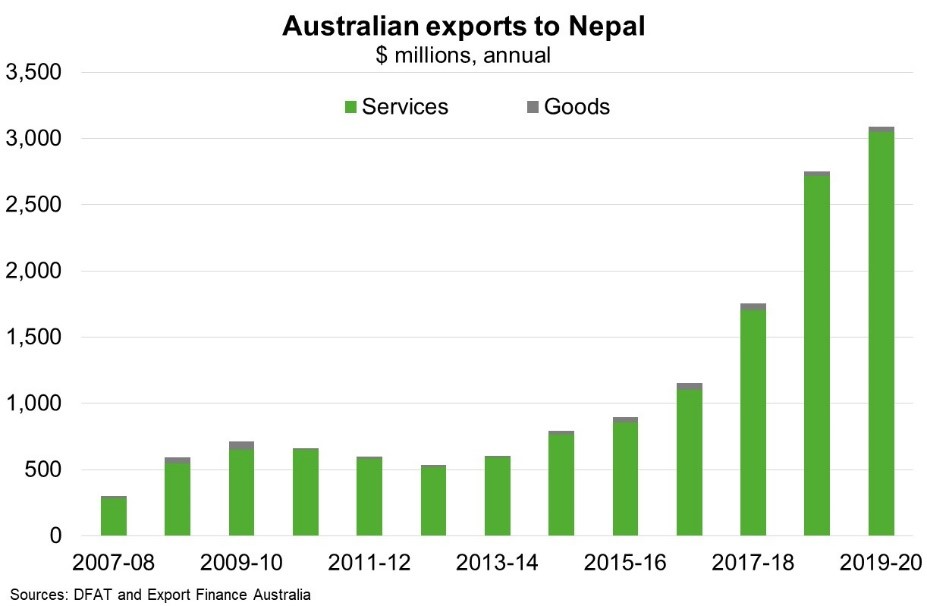

Australian exports to Nepal totalled over $3 billion last financial year (Chart), dominated by education. Nepal is our 7th largest services export market, following average growth of 36% per annum over the last five years. Sustaining this growth will be challenging given Nepal’s political and economic challenges along with ongoing international travel restrictions.