Global—Debt raises global financial market risks

The COVID-19 fallout saw policymakers deploy unprecedented spending packages while government and corporate revenues fell. As such, fiscal deficits swelled and global debt rose by US$24 trillion to a record US$281 trillion (355% of GDP) in 2020. Financing wider fiscal deficits has thus far been relatively smooth, and global economic recovery will see deficits moderate this year. However, high debt loads will sustain fiscal vulnerabilities.

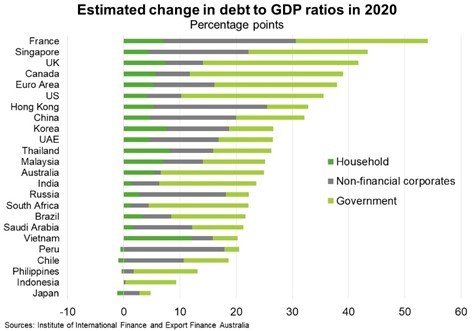

Government debt accounted for about half the rise—up over US$12 trillion in 2020. In emerging markets, China saw the biggest rise in total debt to GDP ratios, followed by Turkey, Korea, and the UAE (Chart); however the run-up in government debt was largest in South Africa and India. The Institute of International Finance expect global government debt to increase by a further US$10 trillion this year to surpass US$92 trillion. Political and social constraints on fiscal consolidation could jeopardise the ability of governments to respond to future crises. Further, many emerging markets will be able to stabilise debt ratios without a disruptive spending adjustment, assuming continued low interest rates. However, were interest rates to rise, fiscal space would disappear fast. In this scenario, only high-growth emerging markets in Asia would be able to simultaneously run primary deficits and stabilise debt.

Household and corporate debt hit 165% of GDP in 2020 (from 124% in 2019). Private sector debt service burdens are now at or above their GFC levels despite historically low interest rates. While many large firms have used additional borrowing to build their cash holdings, SMEs have had more difficulty building these buffers. High leverage could temper new investment. More broadly, a slower recovery or pre-mature exit from exceptional government support schemes could drive bankruptcies and non-performing loans that cause financial instability.