Global—Destabilising inflation risks limited by structural factors

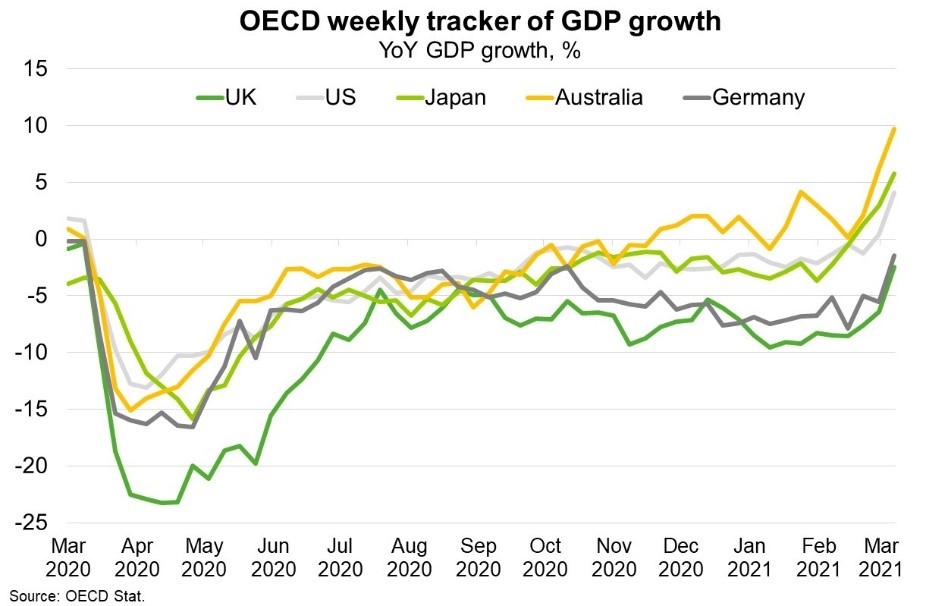

Inflation was below target in 84% of countries at the end of last year. However, improved economic outcomes (Chart) have propelled inflation expectations, particularly in financial markets. China’s economic outperformance and supply shortfalls have driven up food and metals prices. Demand has shifted from services to goods, some of which have seen temporary supply shortages amid production and transport bottlenecks that have raised input costs. US dollar strength has fuelled inflation in some emerging markets.

Unprecedented policy stimulus underpins concern of a looming spike in inflation. Spending by G7 governments amounted to 14% of GDP in 2020—compared to 4% of GDP spent during the GFC (2008–10). Passage of President Biden’s US$1.9 trillion stimulus package (9% of US GDP) has raised concerns about economic overheating. The package is expected to add one percentage point to global economic growth this year and boost US growth even more; the OECD revised its forecast up from 3.2% to 6.5%. Increased protectionism, demographic trends, and a de facto rise in the US Federal Reserve’s inflation target could also facilitate longer term inflation. High inflation could jeopardise economic recovery; possibly necessitating interest rate hikes that create financing problems for highly indebted governments, firms and households.

Thankfully, the IMF expects global inflation to remain subdued given sizeable spare capacity and still weak labour markets. Over 150 countries are expected to have lower per capita incomes in 2021 relative to 2019 despite economic recovery, consumers’ cash savings and fiscal stimulus. Structural factors also diminish the correlation between inflation and economic growth. First, globalisation and technology have long driven down consumer prices. Second, automation has kept prices constant despite higher wages while the market dominance of high profit firms has seen higher costs absorbed. Last, the credibility and independence of central banks has anchored inflation expectations.