Large fiscal stimulus programs provided significant support to emerging market (EM) economies through the COVID-19 pandemic. With borrowing costs at historical lows, fiscal deficits have swelled and public debt has surged. More than two thirds of EM economies are in debt booms, according to the World Bank. On average, the increase in government debt is similar in magnitude to past debt accumulation periods, but has already lasted three years longer. History shows that about half of such debt booms were associated with financial crises either during the boom itself or in the two years after the end of the boom. Sovereign debt distress can spread to commercial banks, reflecting large bank holdings of government debt. Bank failures would damage the flow of credit to businesses and consumers and potentially further undermine government balance sheets if bail outs ensue.

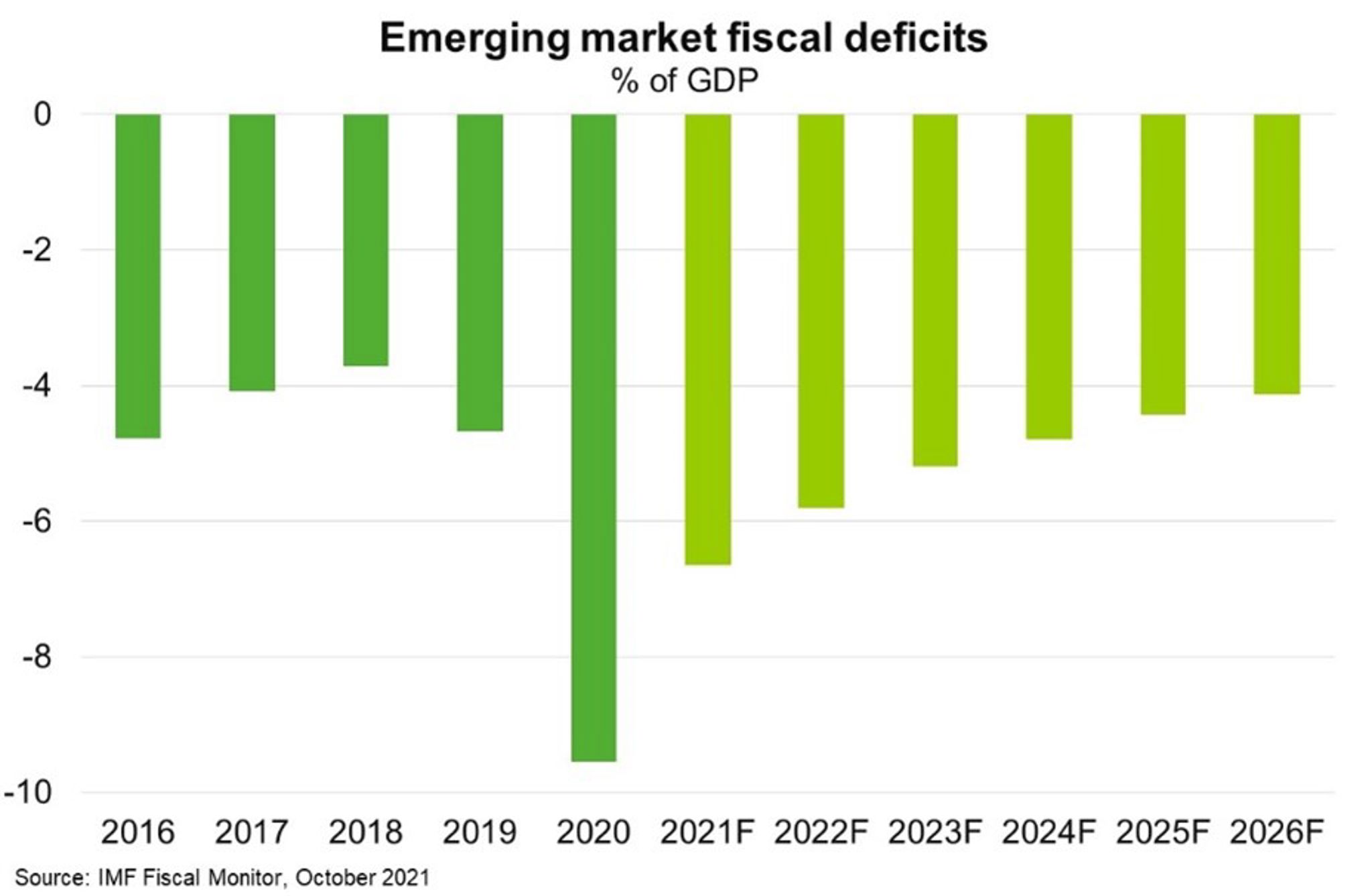

Moving forward, many EMs are planning to make large spending cuts to consolidate public finances (Chart). This reduces risks of a financial crisis, but will likely weigh on near term GDP growth. Cutting back on support measures for households and businesses may hit consumption and investment. Reduced government spending could also raise political and social tensions in countries that are trying to reduce social inequalities. If inflation pressures prove more persistent, sovereign bond yields are likely to rise more sharply, increasing debt servicing costs and leaving even less room for public investment. The Institute of International Finance estimates fiscal consolidation will subtract 0.5 percentage points from EM GDP growth in 2022, after adding 1.2 percentage points in 2021.

The timing and pace of fiscal consolidation in EMs will depend on the spread of COVID-19 and the pace of vaccination. As a group, the IMF expects EM debt to remain about 15 percentage points higher in 2026 than pre-pandemic levels. Higher public debt for longer will make it challenging for many EMs to stimulate their economies if future shocks arise.