Emerging markets—Interest rate hikes compound growth challenges

The global economic recovery remains strong and global GDP now exceeds its pre-pandemic level. But recoveries have been uneven and economic momentum slowed for the third consecutive month in August, according to the JP Morgan Global Composite PMI. OECD retail sales spending also weakened slightly in July, while industrial production and global merchandise trade growth moderated.

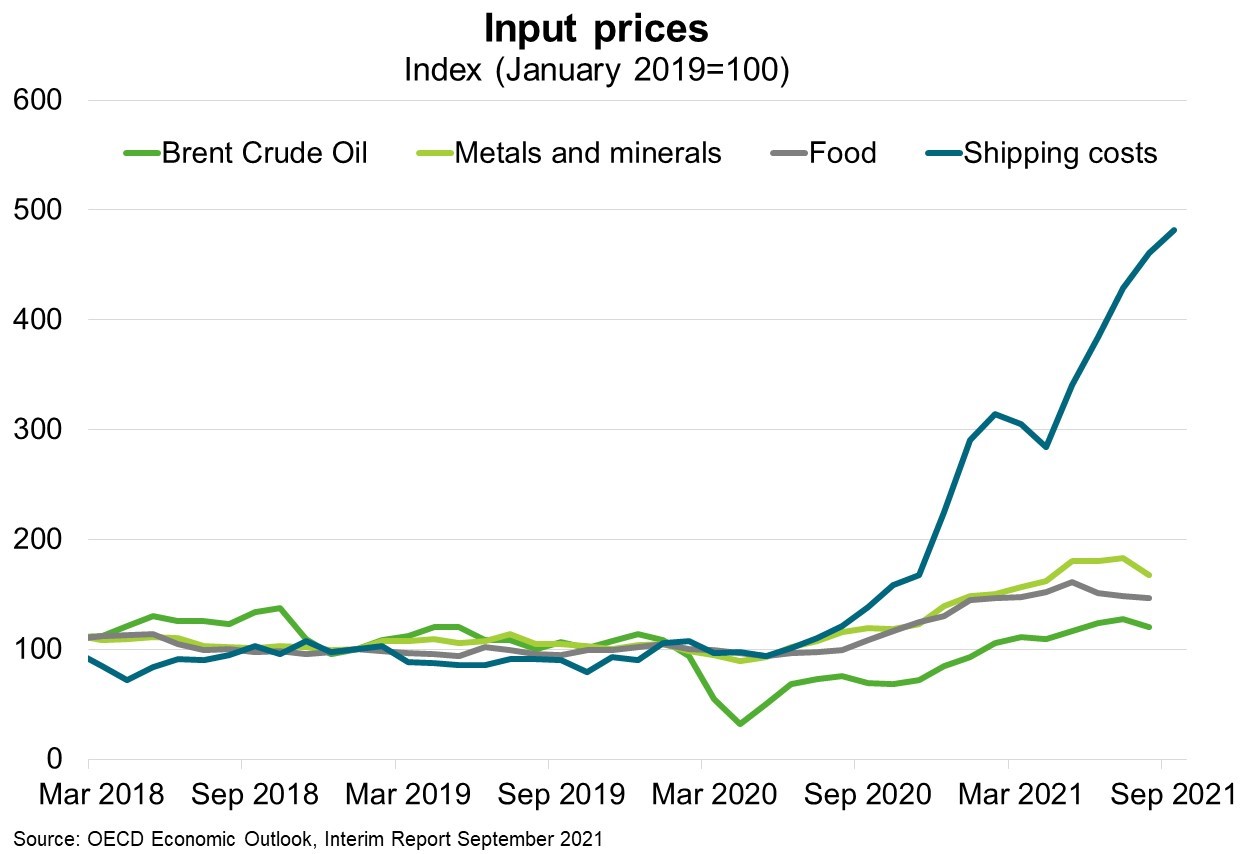

Spread of the Delta variant is dampening growth but also exacerbating global supply chain disruptions, driving up consumer prices. The OECD forecasts G20 inflation will peak at 4.5% in Q4 2021, with higher commodity prices and shipping costs (Chart) contributing one-third of the annual gain. These inflationary pressures should prove temporary, but inflation expectations may not be as firmly anchored in emerging markets. As such, emerging market central bankers have acted decisively to curb inflation relative to their advanced economy counterparts. Brazil’s central bank has hiked interest rates by 4.25 percentage points since March, while Russia, Turkey, Hungary, Chile, Mexico and Peru have also raised rates this year. Other emerging market central banks are expected to follow suit in coming months.

This determination to curb inflation, along with improved economic fundamentals, has helped maintain investor confidence and avoid destabilising capital outflows. Similarly, exchange rate depreciations have been modest, limiting inflation arising from higher import costs. But large interest rate hikes could slow growth and raise fiscal risks. Slower growth would weigh on public revenues, while higher interest rates simultaneously raise borrowing costs for governments. Indeed, Brazil’s central bank governor has publicly worried that the market’s ‘perception of fiscal deterioration’ could endanger the economic recovery. Inflation pressure is expected to ease as supply bottlenecks ease and global demand cools. However, new COVID-19 outbreaks, social unrest or severe weather could yet see further supply disruptions and inflationary pressure.