Brazil—Reform momentum buoys investors' spirits, economic potential

Business and investor confidence in Brazil is improving amid resilient export performance and reform momentum under the new government of President Luiz Inácio “Lula” da Silva. Booming agricultural exports prompted the IMF to upgrade its 2023 GDP growth forecast to 2.1%, from 0.9% forecast in April. Meanwhile, inflation fell to 4% y/y in July 2023, from 12% in April 2022. This allowed a 50 bp cut to interest rates this month following a year of borrowing costs being held at 13.75%—among the highest in the world. Despite the uncertain global environment, Brazil’s sound financial system, strong buffers and flexible exchange rate support continued resilience.

Lula’s government is progressing important reforms, including initiatives to support the private sector, that appear to be buoying investor spirits. This is despite political polarisation that manifested most vividly in violent protests on 8 January in Brasilia. First, the lower house recently approved reforms to Brazil’s notoriously complex tax system. If approved by the Senate, the new tax code would come into force in 2026. By removing a key competitiveness bottleneck, authorities estimate GDP could grow by 1.5% within a year of its implementation. Second, new fiscal rules expected to be passed this year should help to stabilise public finances. That said, given President Lula’s social spending orthodoxy, fiscal consolidation is reliant on (perhaps overly) ambitious revenue targets.

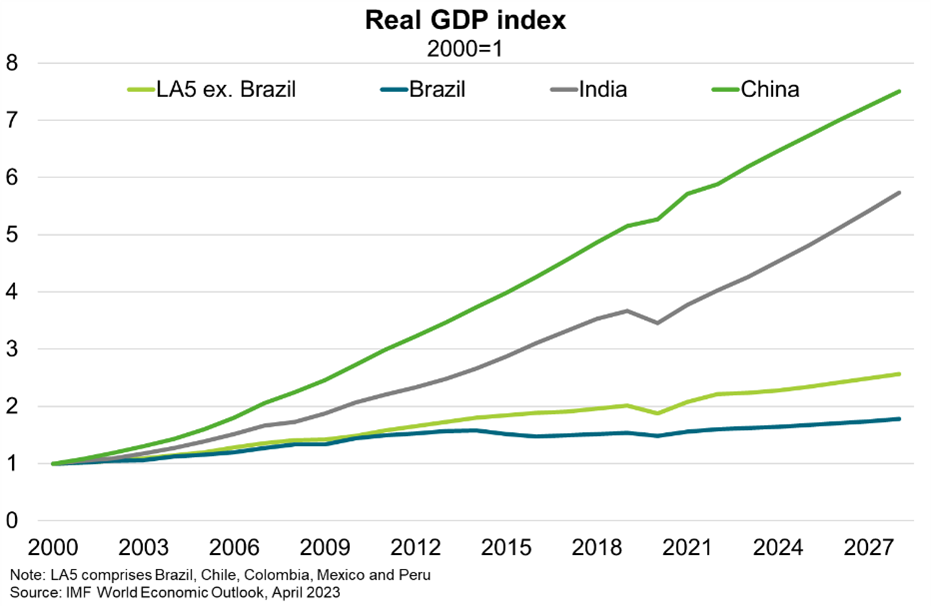

FDI into Brazil doubled to US$86 billion in 2022, making it the fifth largest host economy. A recent credit rating upgrade, the new infrastructure-focused ‘Growth Acceleration Program’, Brazil’s potential to produce clean energy and sign a EU—Mercosur (Brazil, Argentina, Paraguay, Uruguay) free trade deal could further boost investment. However, real GDP contracted 0.3% p.a. on average between 2014 and 2019. Consistent reform implementation is required to boost growth potential (which, at 2% p.a., is lower than emerging market peers) and reverse a long-term trend of underperformance in Australia’s largest Latin American export market (Chart).