2024—Global economic slowdown and continued moderation of inflation

Over the next two years, the global economy will be characterised by a moderate slowdown followed by eventual normalisation. Recent OECD forecasts suggest global economic growth will ease to 2.7% in 2024, the lowest annual rate since the GFC other than the first year of the pandemic. Weak performance reflects the impact of tight financial conditions, weak trade growth and lower business and consumer confidence. In the absence of further large shocks to food and energy prices, inflation is expected to continue to abate, but converge back to central bank targets in most major economies only by the end of 2025. As real incomes strengthen and central banks begin to cut interest rates, global growth is expected to edge up to 3% in 2025. Global trade growth is also forecast to recover gradually (to 2.7% in 2024 and 3.3% in 2025, up from 1.1% in 2023), alongside global demand, the end of inventory declines and a recovery in investment growth.

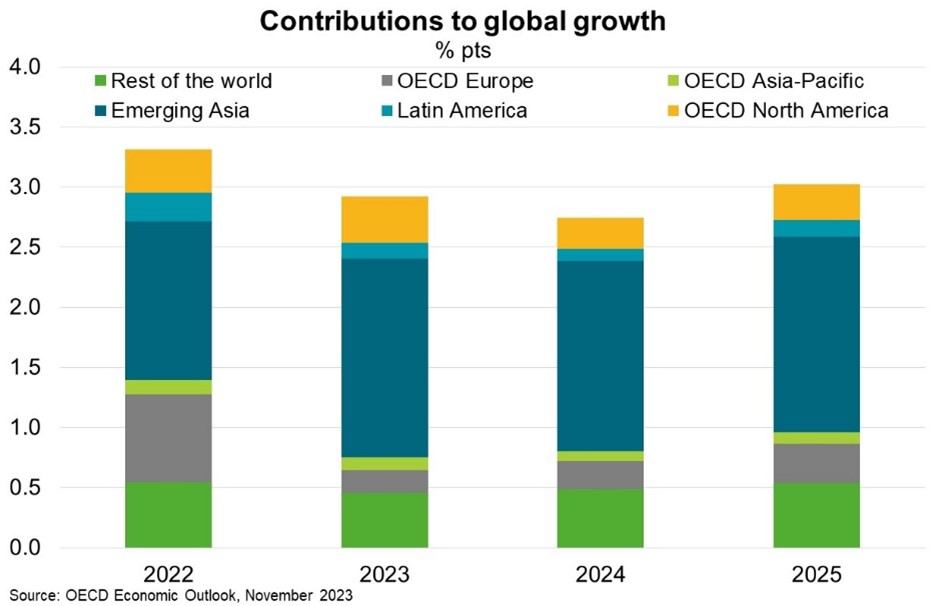

The further deterioration in global demand and ongoing inflationary pressures amid elevated geopolitical uncertainty will weigh on the export outlook and business confidence. That said, a growing divergence across economies is expected to persist, with growth in emerging markets generally more resilient than in advanced economies, and growth in the US and major Asian economies more resilient than Europe. Australia’s largest regional export markets are expected to fare relatively well; emerging Asia will continue to be the main growth engine—accounting for nearly 60% of global GDP growth in 2024 (Chart). The IMF expects India (GDP growth of 6.3%), Bangladesh (6.0%), Philippines (5.9%), Vietnam (5.8%) and Indonesia (5%) to be among Asia’s best performers in 2024.