Export outlook—Goods moderate, as services recovery accelerates

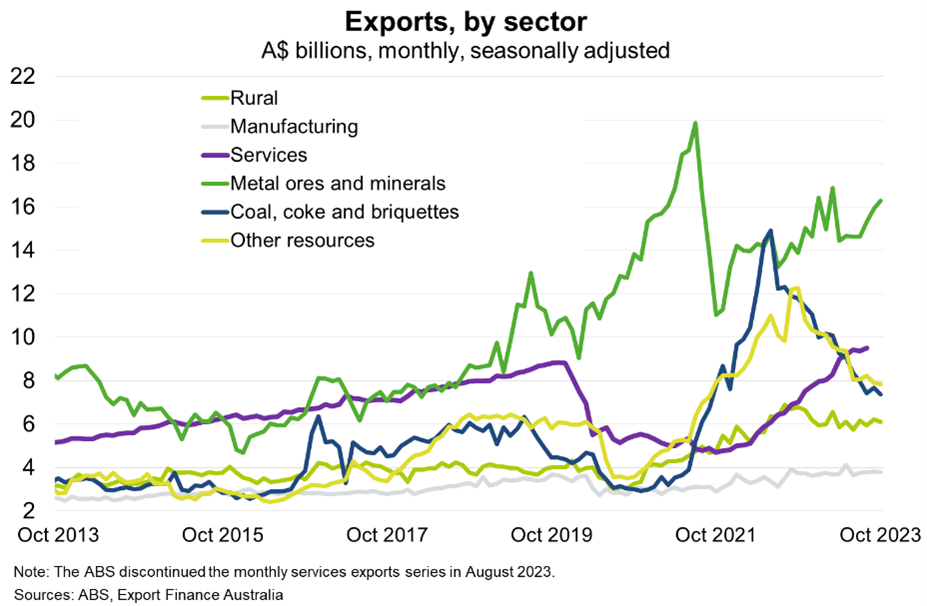

Australian exports proved resilient to challenging global economic conditions in 2023. Resources and energy exports hit a record $467 billion in 2022-23 according to the Department of Industry, Science and Resources (DISR). That reflected higher global commodity prices, increasing industrial demand from China and growing demand for base metals and critical minerals used in low-emissions technologies.

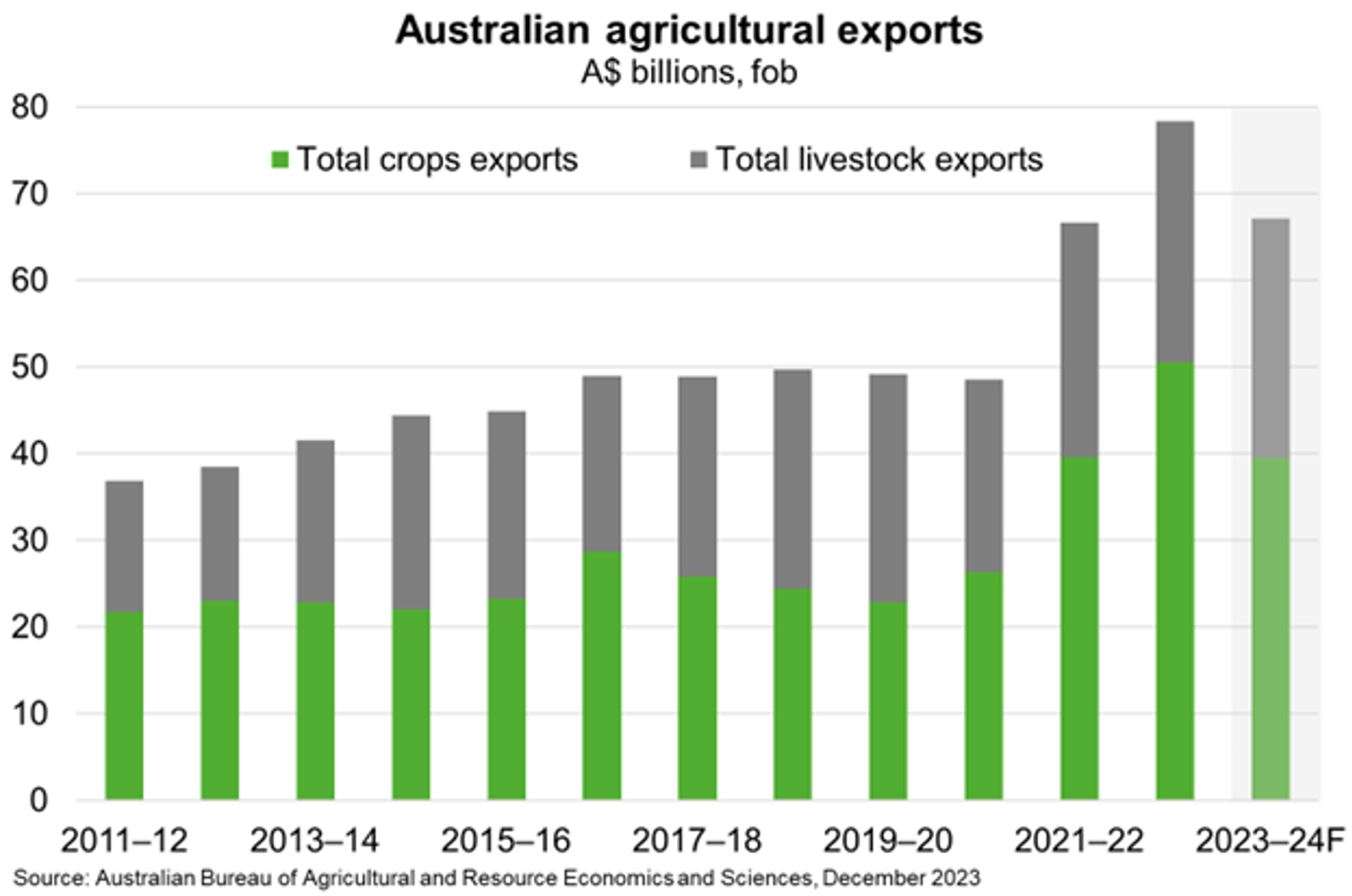

Agriculture exports also hit a record $78 billion in 2022-23, according to the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES), benefitting from higher global prices and favourable growing conditions. This strength is continuing for some sectors; for example, meat exports reached a record in September thanks to robust demand from the US and China. Stabilisation in trade relations with China, which included the removal of trade restrictions on certain Australian commodities, helped lift some exports in 2023, such as barley and thermal coal.

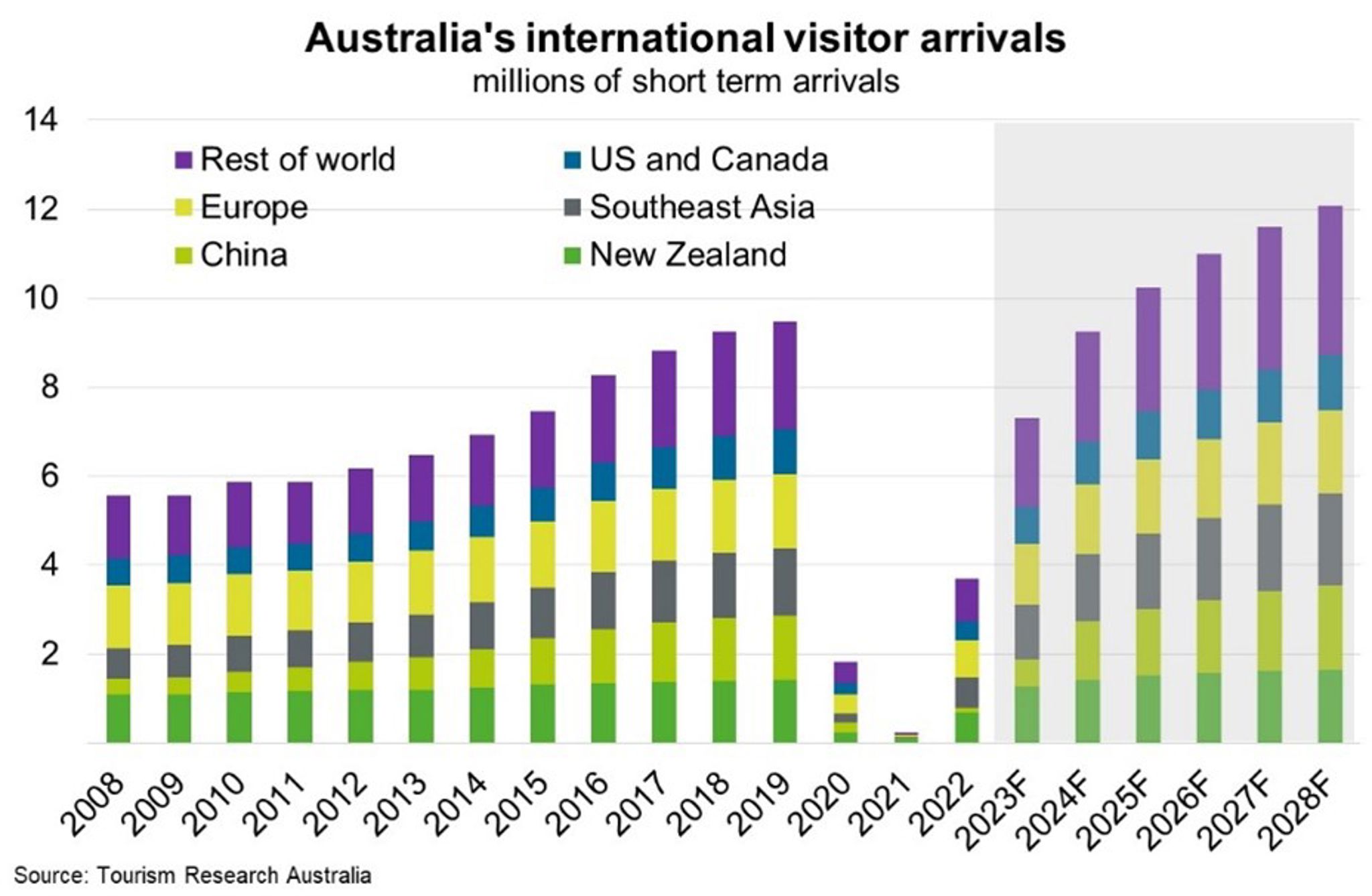

Another year of open borders and China’s economic reopening helped boost education and tourism exports. More than 6.5 million international arrivals visited Australia over the nine months to September 2023, on track to double 2022’s outturn of 3.7 million. The monthly value of services exports exceeded pre-pandemic levels from the middle of the year (Chart) amid a strong recovery of international travel, a trend that is poised to continue.

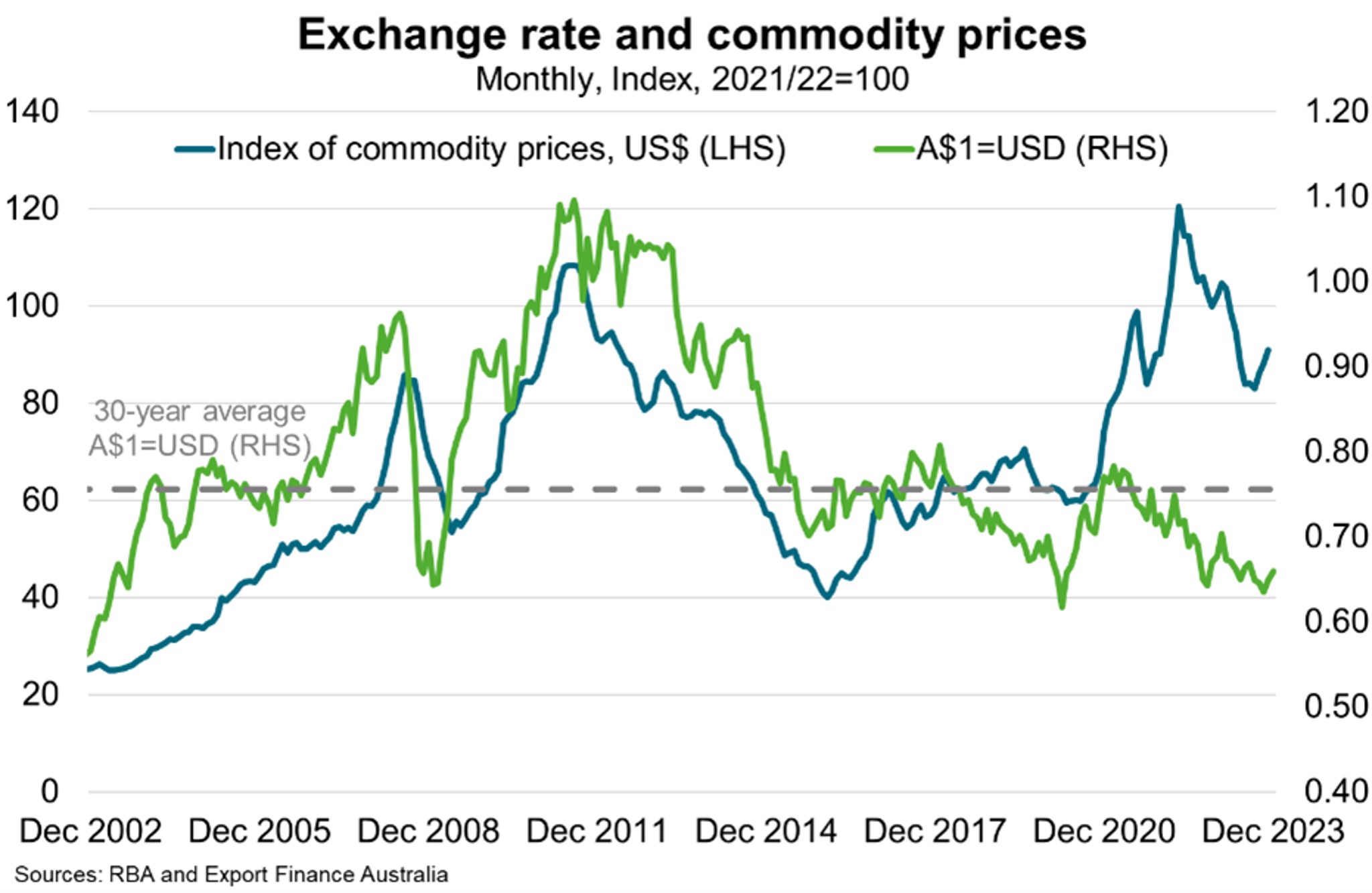

A weaker Australian dollar, which averaged US66 cents through 2023, around 5% below the 2022 average of US69 cents (and well below the 30-year average of US76 cents), improved the international competitiveness of Australian exports.

Exporters remain confident about the outlook for 2024 because of fewer supply disruptions, lower freight costs and a competitive Australian dollar, even as slowing global demand and labour constraints remain significant challenges for many businesses. Improving governance and business conditions and fewer economic and financial vulnerabilities in Australia’s largest export markets bodes well for continued export growth ahead. Australian exporters will continue to benefit from ongoing strong Asian demand, which contributes more than 80% of total exports.

Resources and agriculture exports to remain elevated but fall from record highs

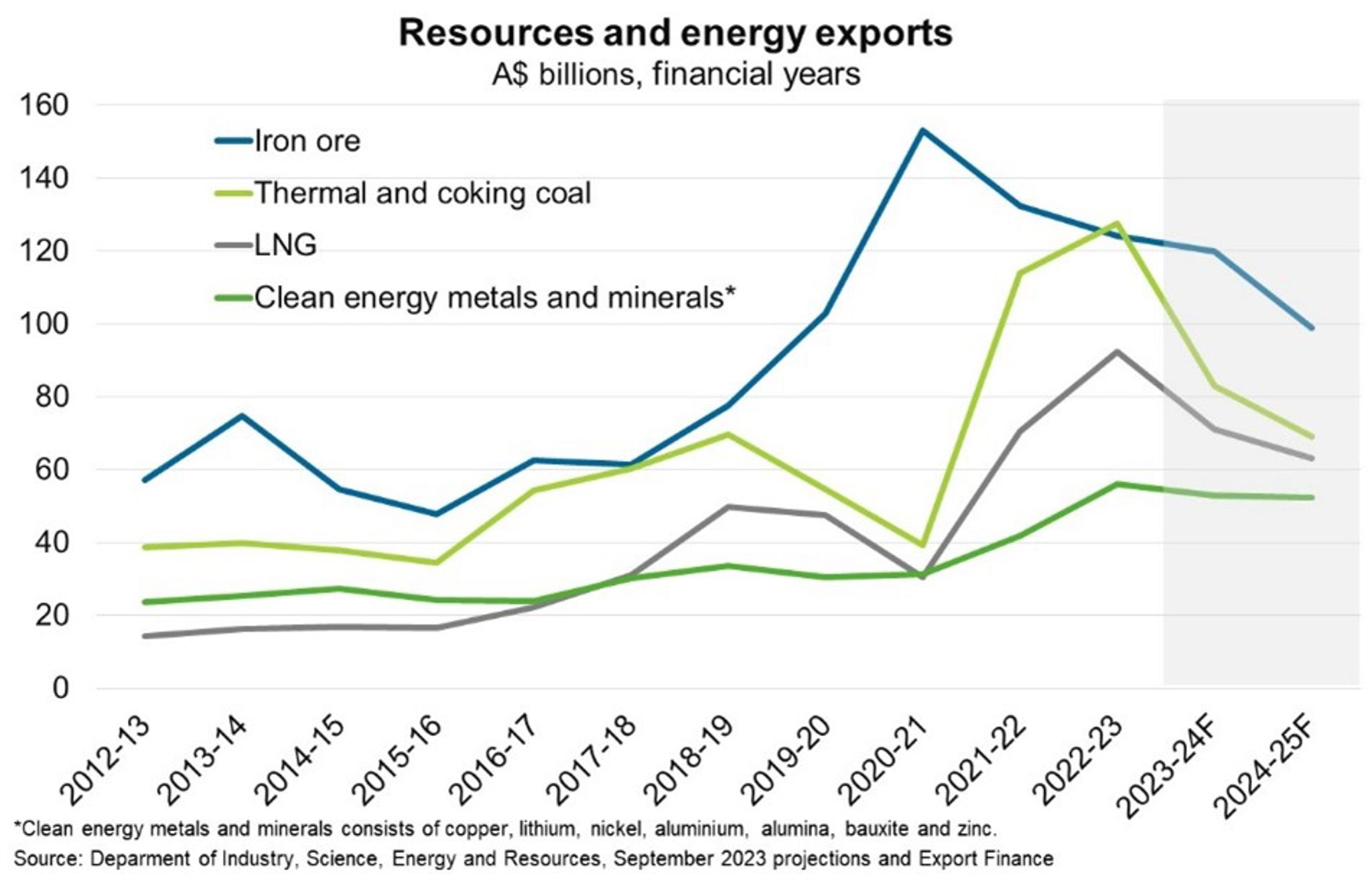

Australia’s resources and energy exports are forecast to drop $67 billion to $400 billion in 2023-24, though this will still be the third-highest level on record. Export volumes are poised to rise for most commodities, but that only partly offsets the impact of lower prices relative to 2022-23 (amid weaker global demand and higher global supply). China is projected to see a modest fall in steel output in 2024 and 2025, reflecting structural drivers: slowing demographics, urbanisation and residential property sales, a shift in growth to less steel-intensive sectors, such as domestic services, and declining returns from additional investment. As China accounts for almost 60% of global iron ore demand, prices and export values for Australia’s largest export product are likely to soften in the coming year (Chart).

Energy export earnings are set to fall more sharply. Carbon-intensive exporters face growing challenges as the global energy transition continues. The International Energy Agency (IEA) now sees global demand for coal, oil and gas peaking in the 2020s due to a rise in renewable technologies, increasing electrification of ground transport and a shift in major economies, including China, away from coal. Prices for thermal and metallurgical coal have already begun to decline from high levels, reducing export receipts. LNG export revenues are forecast to fall from record levels in 2023, as oil and gas prices continue their downward trend from their Russia-Ukraine war-induced spike in 2022 and early 2023.

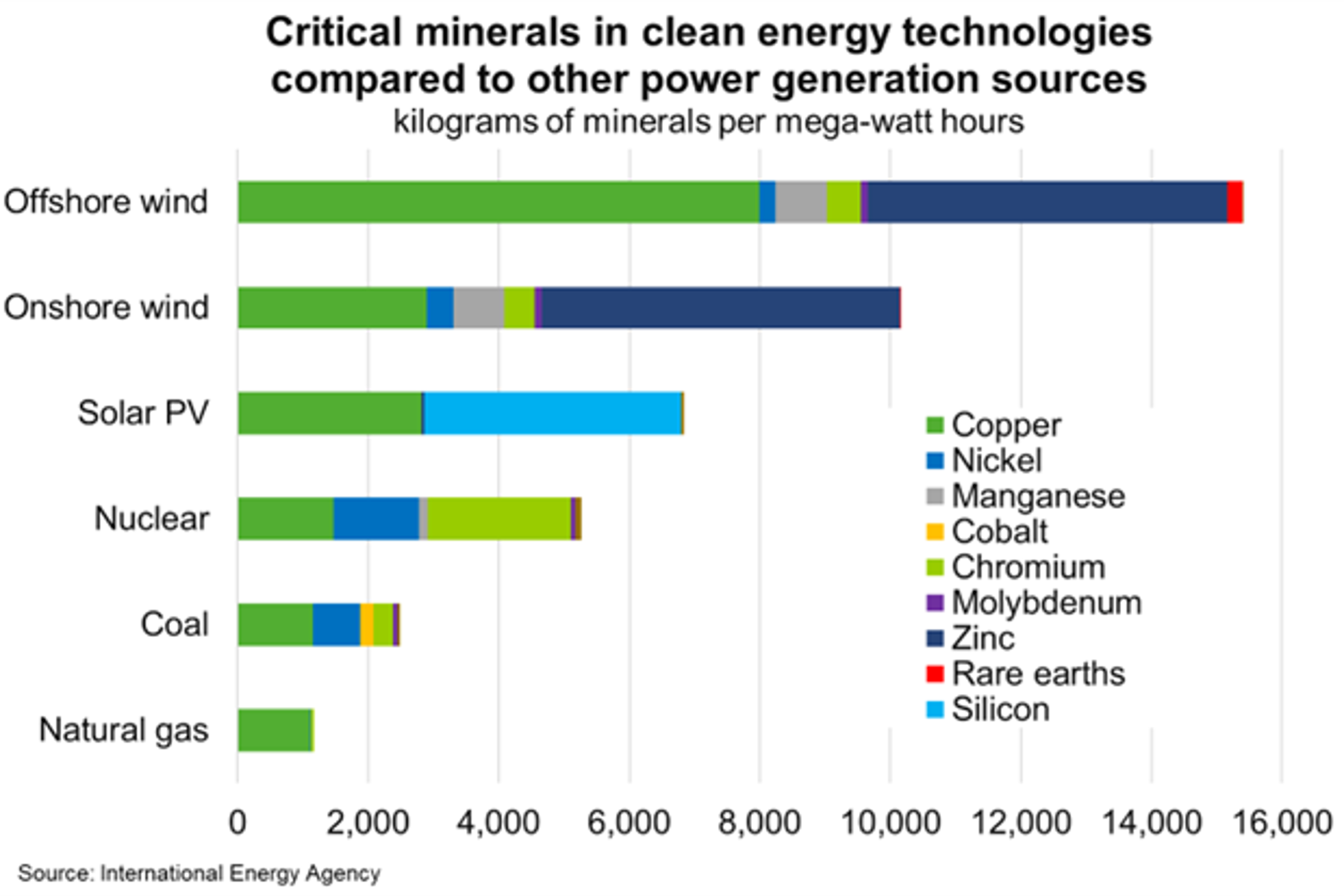

On the positive side, global investment continues to rise in the supply chain of low emission and critical technologies, underpinned by government assistance in many nations. To meet the world’s net zero by 2050 emissions goals, the IEA estimates global demand for critical minerals needs to increase by 350% between today and 2040. For example, a typical electric vehicle (EV) requires six times the mineral inputs of a conventional car while an onshore wind plant requires nine times more mineral resources than a gas-fired plant (Chart). Australia produces 9 of the 10 minerals used in lithium-ion batteries and has projects seeking to develop refineries for the tenth (graphite). Although slowing Chinese demand for EVs and increased supply has weighed on prices for lithium, nickel, rare earths, cobalt and others through 2023, structural drivers of critical minerals prices are positive over the longer term. Exports of clean energy metals and minerals are poised to remain over $50 billion p.a. over the next two years.

ABARES forecasts agriculture exports to decline $11 billion to $67 billion in 2023-24, as drier weather conditions curb crop production and global prices fall. By contrast, livestock export values are predicted to remain robust, as higher export volumes offset lower global prices. At these levels, agricultural exports are still forecast to be the second highest on record. Despite falling global crop prices overall, restricted supply for some commodities will likely see some prices remain elevated in 2023-24. For example, global rice prices will likely remain high due to India’s ban on non-basmati white rice exports which commenced earlier this year. Global sugar prices are also likely to remain high due to port congestion constraining Brazilian exports, subdued production from other key producers, and ongoing robust global demand.

Competitive Australian dollar to support export competitiveness as the services recovery accelerates

The competitive Australian dollar will provide a tailwind for exporters in 2024. The Australian dollar now sits at about US66 cents—well below the 30-year average (Chart). Futures markets pricing as of mid-December suggests the AUD will remain steady at around US65-66 cents over the next two years. That said, the AUD faces downward pressure from higher interest rates in the US, forecast lower prices for Australia’s key commodity exports and a slowing Chinese economy.

The competitive Australian dollar, ongoing strong demand from key Asian markets, the continued reopening of flight routes and commencement of new flight routes to Australia should support further recovery in tourism and education exports in 2024. The restart of group tour travel from China to Australia in September should support faster growth in Chinese visitor arrivals in 2024. According to Tourism Research Australia’s (TRA) November 2023 forecasts, the number of short term visitor arrivals is expected to reach pre-pandemic levels in 2024 (Chart). Notably, TRA forecasts international spend to grow at a slightly faster rate than arrivals (as it did before the pandemic), supporting a wide range of service industries such as hotels, restaurants and retail. This trend primarily reflects increased travel costs in Australia relative to pre-pandemic levels and the continued recovery of higher average-spend purposes of travel, such as holidays and education. On the education front, the government is easing post-pandemic policies that boost international education, which included allowing international students to work more hours and increased post-study visa rights. While this will likely slow the pace of growth in international student enrolments, overall student numbers are still likely to surpass the record 900,000 enrolments achieved year-to-date in September. Australia’s high-quality education, work opportunities and safe and friendly environment will continue to support overseas demand for Australian education.