World—Geopolitics drives risk of higher oil prices and stagflation

Geopolitics drives risk of higher oil prices and stagflation

Recent conflict in the Middle East has not materially impacted oil supplies so far. Indeed, the oil market could shift into surplus next year as the global economy slows, according to the IEA. That said, geopolitical volatility will remain high. Gold prices—which typically rise during periods of economic uncertainty—are up 11% since the conflict began. The Middle East produces a third of global oil and the Strait of Hormuz is the world’s busiest oil-shipping channel. Escalation into a regional war would increase commodity prices and drive global stagflation (rising inflation and lower growth).

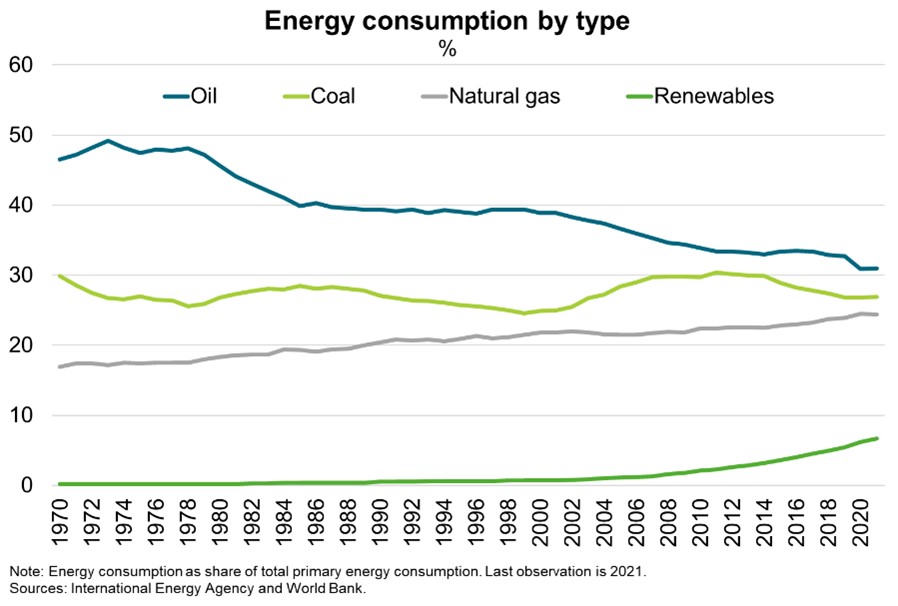

The World Bank outlines various risk scenarios based on historical experience since the 1970s. In a ‘medium disruption’ scenario—roughly equivalent to the Iraq war in 2003—global oil supply would be curtailed by 3 to 5 million barrels per day, driving prices up by 21% to 35%. In a ‘large disruption’ scenario—comparable to the Arab oil embargo in 1973—global oil supply would shrink by 6 to 8 million barrels per day, driving prices up by 56% to 75%, towards their historical peaks. Notably, the global economy has improved its ability to absorb oil price shocks since the 1970s; the intensity of oil use has declined due to improved energy efficiency, diversification of supply (Chart), and the increased importance of services.

Nonetheless, oil remains a vital transportation fuel. As such, the IMF estimate that a 30% rise in oil prices could reduce global GDP by 0.5% and raise inflation by 1.2 percentage points. Among Australia’s large export markets, Indonesia and Malaysia could benefit from higher oil prices given they are net energy exporters (including coal, palm oil and LNG). However, countries like India, the Philippines and Thailand are particularly exposed.