Pakistan — US$7 billion IMF bailout provides reprieve amid debt crisis

Pakistan has reached IMF staff-level agreement for a 37-month Extended Fund Facility (EFF), worth around US$7 billion (more than 2% of GDP). Pakistan—the second-largest economy in South Asia and home to 240 million people—was on the brink of default last year before the IMF granted a US$3 billion financing package, which expired in April 2024. Economic performance has since improved. Inflation has receded, to 13% in June from 29% a year earlier, and the economy is expected to expand 2% this year, after contracting 0.2% last year. The new IMF program, which will catalyse funding from other bilateral and multilateral development partners, will help anchor expectations for macroeconomic stability.

Still, Pakistan’s external position remains fragile. External financing needs will average US$25 billion p.a. for the next five years, according to the IMF. Meanwhile, foreign exchange reserves have grown, but remain well below the country’s needs at US$9.4 billion. IMF conditionality includes far-reaching and difficult reforms, including to broaden the tax base to the agriculture, retail and export sectors, privatise state-owned enterprises’, adjust energy tariffs, phase out agricultural support prices and subsidies, advance anti-corruption and transparency reforms, and liberalise trade policy. Public discontent over tough IMF-mandated reforms amid high living costs may see a resurgence of social tensions and political instability. The authorities’ ability to sustain reform implementation will be critical to continued external financing and durable economic improvement.

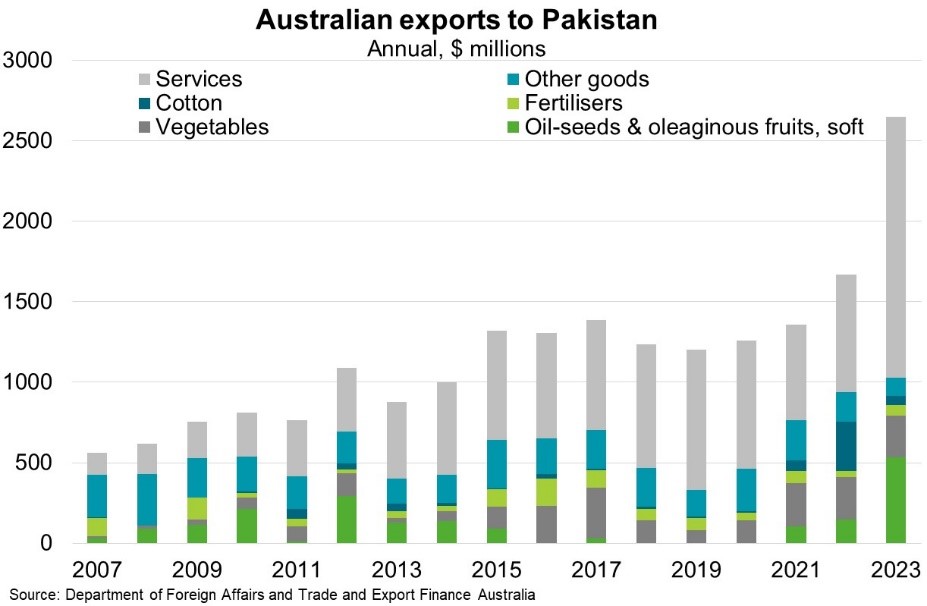

Australian exports to Pakistan have growth strongly, by an average 15% p.a. over the five years to 2023, to $2.6 billion (Chart). Pakistan is now Australia’s 26th largest export market. Despite persistent political and economic instability risks, export prospects—particularly for education, agribusiness, clean energy technologies, water management and IT and communications—will benefit from continued IMF financing and reform conditionality.