Asia — Continues to drive global growth, but currency pressures mount

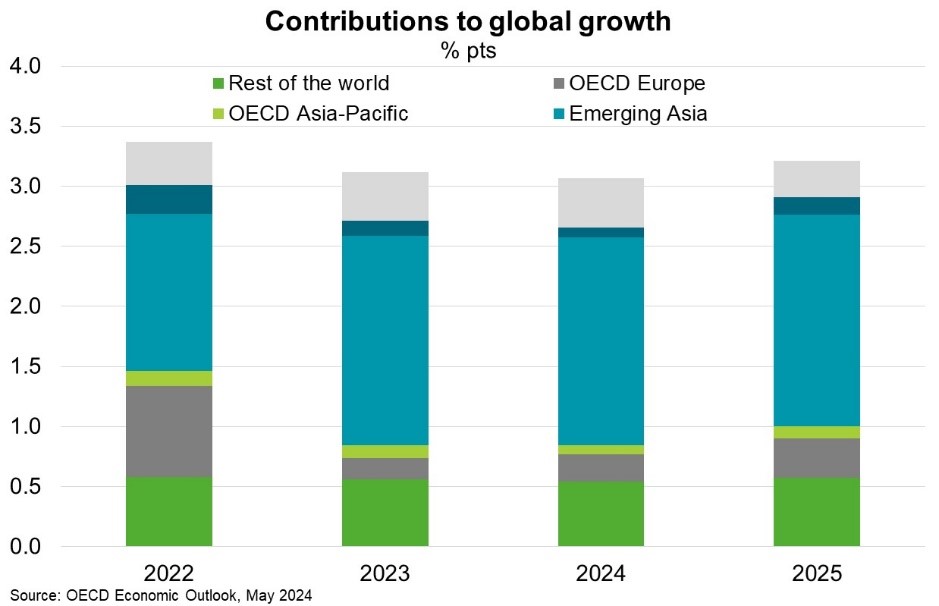

After outperforming expectations in late 2023, the IMF forecasts growth in emerging Asia to slow modestly, from 5.6% in 2023 to 5.2% in 2024. Still, the OECD expects emerging Asia to contribute almost 60% of global growth this year (Chart). Growth in India and the Philippines is forecast to remain strong, at 6.8% and 6.2% respectively for 2024, supported by resilient public investment and domestic demand. However, China’s economic expansion is forecast to slow to 4.6% in 2024 and 4.1% in 2025, reflecting continued weakness in the property sector, subdued productivity growth and population aging. Meanwhile, growth is expected to remain steady in Indonesia (at about 5%) and Malaysia (at about 4.4%) but be more subdued in Thailand (at 2.7% in 2024), where fiscal stimulus prospects have dimmed.

Several risks dominate the outlook. First, buoyant economic activity and slower-than-expected disinflation in the US are increasingly expected to postpone US Federal Reserve rate cuts. IMF analysis shows that US interest rates have a strong and immediate impact on Asian financial conditions and exchange rates. Unusually low policy rates in Asia relative to the US could induce sharp currency depreciations and significant capital outflows that force Asian central banks to delay monetary easing and weaken growth outcomes. Indeed, Indonesia’s central bank raised its benchmark interest rate by 25 bps to a record 6.25% last month despite being within-target inflation. Bank Indonesia stressed that the deteriorating global risk environment and US dollar resurgence warranted the “pre-emptive and forward-looking” policy response to support the rupiah and domestic price stability. Despite new measures to revive China’s debt-stricken property sector, spillovers from a deeper correction remain another important risk, while geoeconomic fragmentation and geopolitical tensions cloud Asia’s medium term prospects.