© Export Finance Australia

The views expressed in World Risk Developments represent those of Export Finance Australia at the time of publication and are subject to change. They do not represent the views of the Australian Government. The information in this report is published for general information only and does not comprise advice or a recommendation of any kind. While Export Finance Australia endeavours to ensure this information is accurate and current at the time of publication, Export Finance Australia makes no representation or warranty as to its reliability, accuracy or completeness. To the maximum extent permitted by law, Export Finance Australia will not be liable to you or any other person for any loss or damage suffered or incurred by any person arising from any act, or failure to act, on the basis of any information or opinions contained in this report.

Major export markets—Economic strength limits Emerging Asia risks

The IMF expects real GDP growth in emerging markets (EM) to remain steady at 4.2% p.a. in 2024 and 2025 after a similar outturn in 2023. Meanwhile, global trade is expected to grow in line with GDP, hitting 3.3% annually in 2024 and 2025, following a period of near stagnation in 2023. However, downside risks are large. Global growth could disappoint due to a) mounting geopolitical risks, including conflict between Russia and Ukraine and in the Middle East, b) more protectionist trade and industrial policies that increase tensions between the US and China, and/or c) higher global inflation. These outcomes would result in lower global trade than the IMF forecasts, hitting export-oriented economies, particularly in Asia.

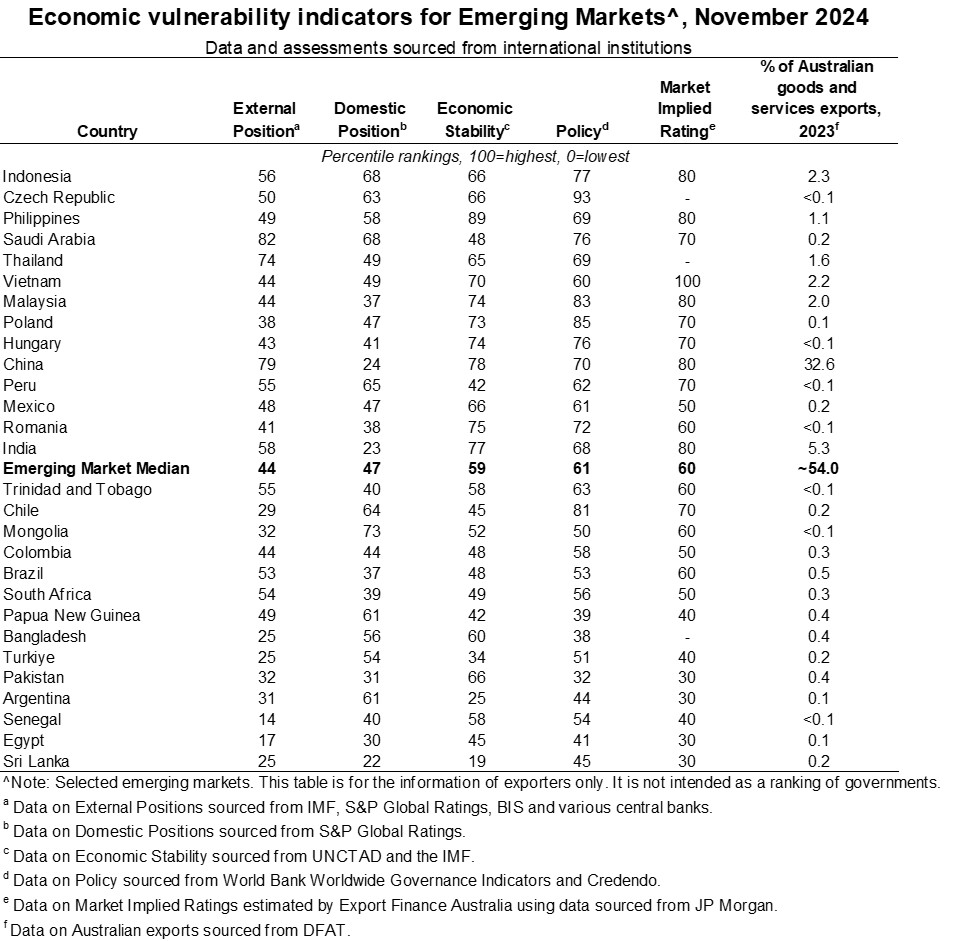

International institutions and financial market analysts, including the IMF, World Bank and S&P Global Ratings, use a range of indicators to assess the EMs most exposed to these risks.

- External position—what is the external debt and reserves position? Is the current account in deficit and how far has the currency deviated from its long term average?

- Domestic position—how leveraged is the private and public sector?

- Economic stability—what is the growth and inflation outlook? How reliant is the country on commodity exports, given the volatility in global commodity prices?

- Policy effectiveness—how effective is the regulatory environment and how severe are political risks?

- Market implied ratings—what do market risk premiums on foreign currency denominated bonds imply about market risk appetite?

Based on these indicators, many of Australia’s major emerging Asia export markets—such as Indonesia, Philippines, Thailand, Vietnam and Malaysia—are relatively less exposed (Table). These economies benefit from resilient domestic demand and global demand for manufacturing goods, particularly electronics. Financial stability risks are contained amid moderate government debt burdens and solid external positions. Rising incomes, favourable demographics and reforms to remove regulatory obstacles and enhance the business environment all help reduce economic vulnerabilities.

China and India also remain above the EM median. India’s infrastructure push is making it one of the fastest growing major economies in the world, while solid foreign reserve buffers support resilience to external shocks. This is balanced against India’s high public debt and low revenue generation, a weak but improving financial sector and lagging structural issues. China remains less vulnerable than most EMs thanks to its continued, albeit slowing, economic growth, supported by policy stimulus. However, China’s struggling property market, weak consumer confidence, ongoing deflation and geopolitical tensions contribute to rising economic vulnerabilities.

Other major export markets sit below the EM median. For instance, while PNG is making strong progress on reforms half-way through its IMF program, economic vulnerabilities remain high amid a (albeit reducing) foreign exchange backlog, delays in investment decisions for large gas projects, and political volatility and violence. Meanwhile, political instability in Pakistan and Bangladesh has dented public and external finances, prompting the IMF to agree packages to shore up economic and financial stability.