© Export Finance Australia

The views expressed in World Risk Developments represent those of Export Finance Australia at the time of publication and are subject to change. They do not represent the views of the Australian Government. The information in this report is published for general information only and does not comprise advice or a recommendation of any kind. While Export Finance Australia endeavours to ensure this information is accurate and current at the time of publication, Export Finance Australia makes no representation or warranty as to its reliability, accuracy or completeness. To the maximum extent permitted by law, Export Finance Australia will not be liable to you or any other person for any loss or damage suffered or incurred by any person arising from any act, or failure to act, on the basis of any information or opinions contained in this report.

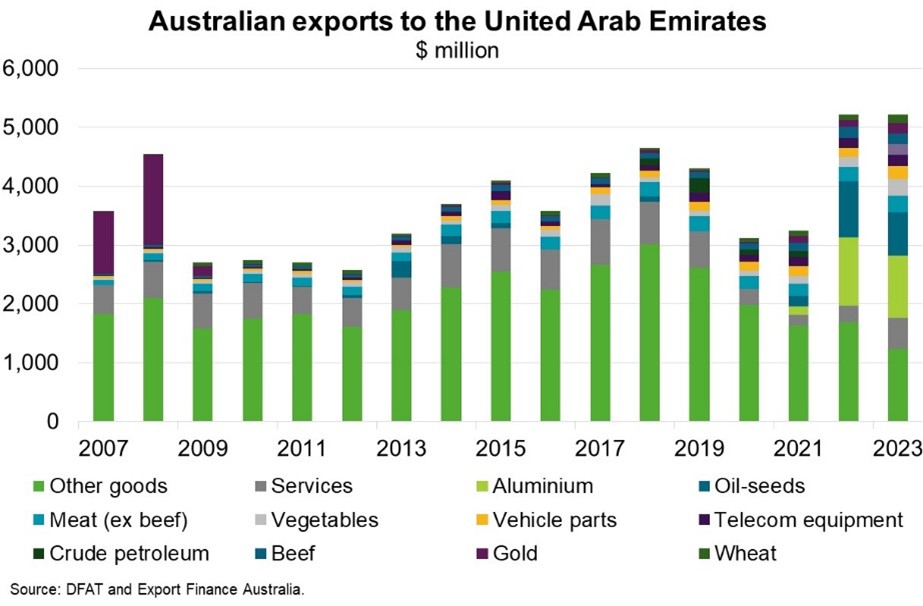

UAE—Free trade deal and economic growth fuel export opportunities

The United Arab Emirates (UAE) is Australia’s largest export market in the Middle East, with total goods and services exports of $5.2 billion in 2023 (Chart), nearly 1% of total exports. The Australia-UAE Comprehensive Economic Partnership Agreement (CEPA) has become the first bilateral free trade agreement that Australia has signed with a Middle Eastern country, after negotiations commenced in December 2023. When fully implemented, CEPA will eliminate tariffs on over 99% of Australia’s exports to the UAE, with most tariffs eliminated on entry-into-force or locked in at zero and others eliminated over three or five stages. This makes CEPA the most liberalising FTA the UAE has agreed to date, providing Australian exporters with a comparative advantage. Alongside important export diversification benefits, independent modelling estimates a potential annual increase in Australian goods exports of $678 million. For instance, food and beverage exporters will gain preferential access to the UAE’s growing market for premium agricultural products. Australian critical minerals projects will benefit from a framework to encourage UAE investment. Meanwhile, CEPA locks in market access to over 120 services sectors in the UAE—including engineering, accounting, medical and education.

Aside from improved market access, Australian exporters will benefit from the UAE’s business-friendly diversification efforts delivered through regulatory, residency and labour market reforms. While weaker global oil prices are expected to constrain the recovery in oil production, non-oil GDP is contributing an increasing share of the UAE’s overall economic activity. The IMF forecasts GDP growth to accelerate to 4.0% in 2024 and 5.1% in 2025, from 3.6% in 2023. Despite considerable uncertainty and external risks—including from geopolitical tensions, commodity price volatility and global decarbonisation efforts—the UAE maintains large public financial buffers, while accelerated investment and structural reforms could spur even faster growth ahead.