© Export Finance Australia

The views expressed in World Risk Developments represent those of Export Finance Australia at the time of publication and are subject to change. They do not represent the views of the Australian Government. The information in this report is published for general information only and does not comprise advice or a recommendation of any kind. While Export Finance Australia endeavours to ensure this information is accurate and current at the time of publication, Export Finance Australia makes no representation or warranty as to its reliability, accuracy or completeness. To the maximum extent permitted by law, Export Finance Australia will not be liable to you or any other person for any loss or damage suffered or incurred by any person arising from any act, or failure to act, on the basis of any information or opinions contained in this report.

World—Financial risks reflect uncertainty and vulnerability

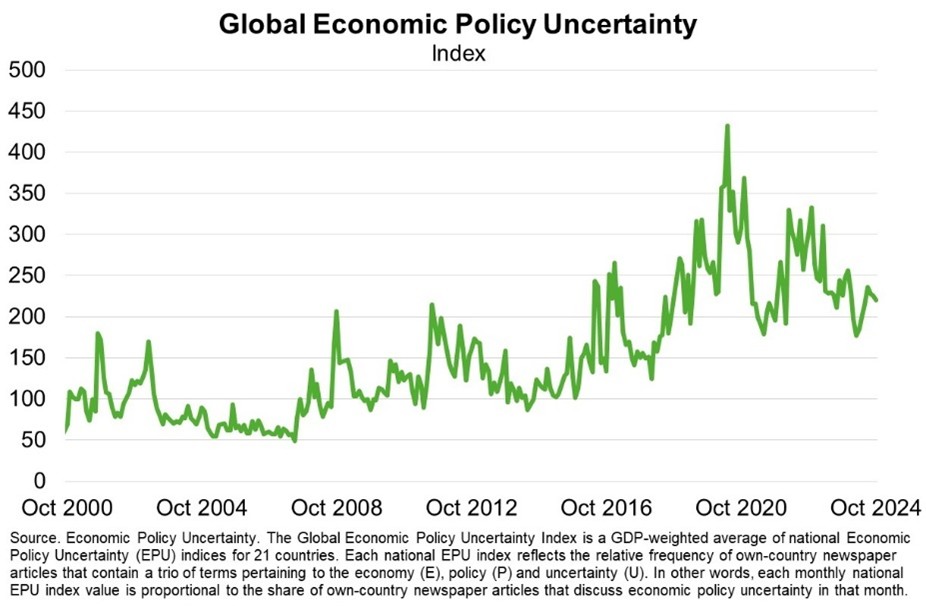

Near term financial stability risks remain contained with the global economy on track for a soft landing and inflation continuing to decline, allowing most central banks to ease interest rates. However, the IMF warns that medium term prospects require vigilance. First, vulnerabilities arise from lofty asset valuations and increased government and private sector debt. Second, the disconnect between high economic policy uncertainty (Chart) and low financial market volatility suggests that asset prices may not fully reflect the potential impact of military conflicts and trade disputes. This disconnect increases the chance of sharp asset repricing. While market turmoil in August proved temporary, it provided a glimpse into a scenario where shifting sentiment quickly amplifies volatility.

Preserving financial stability in emerging markets may also become more challenging as trade policy uncertainty and a stronger US dollar weigh on economic prospects. US President Donald Trump has pledged a 10-20% across-the-board tariff and a 60% levy on all Chinese imports. While “China plus one” supply chain diversification has driven foreign investment across Asia, new trade distortions would drag on regional growth. The US is the largest export market for ASEAN, China, India and Japan. And many Asian countries’ exports to China are subsequently re-exported to the US. Moreover, ASEAN’s trade intensity, measured as the ratio of trade to GDP, is twice the global average. Even if a trade war is avoided, IMF research finds that a one standard deviation increase in uncertainty induces a 4.5% fall in bilateral trade, with stronger negative effects in countries deeply ingrained into global supply chains. The strengthening US dollar, fuelled by rising US yields, is also likely to drive inflation in import-reliant countries, potentially prompting higher interest rates that limit investment and economic growth. These currency dynamics also increase debt service costs for many emerging markets with US-denominated debt.