© Export Finance Australia

The views expressed in World Risk Developments represent those of Export Finance Australia at the time of publication and are subject to change. They do not represent the views of the Australian Government. The information in this report is published for general information only and does not comprise advice or a recommendation of any kind. While Export Finance Australia endeavours to ensure this information is accurate and current at the time of publication, Export Finance Australia makes no representation or warranty as to its reliability, accuracy or completeness. To the maximum extent permitted by law, Export Finance Australia will not be liable to you or any other person for any loss or damage suffered or incurred by any person arising from any act, or failure to act, on the basis of any information or opinions contained in this report.

Asia—Economic resilience supported by trade recovery

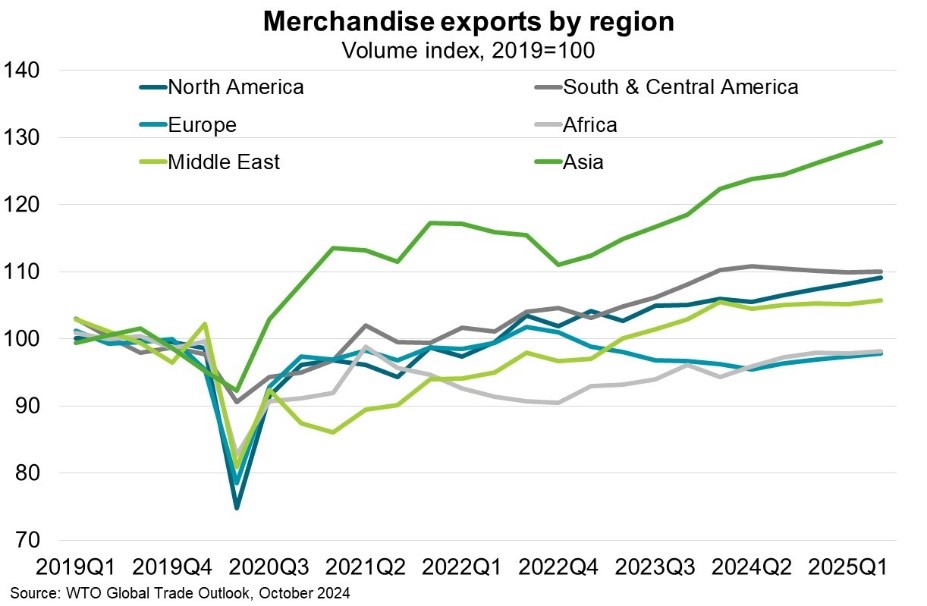

The World Trade Organisation (WTO) forecasts global goods trade to expand 2.7% in 2024 and 3.0% in 2025, following a -1.1% slump in 2023. Declining inflation has allowed advanced economy central banks to ease interest rates, which is expected to stimulate consumption and investment and support the global trade recovery. Asia’s exports are forecast to grow faster than those of any other region this year and next, rising by 7.4% and 4.7% respectively. By mid-2025 this would see Asian exports up 29% compared to their 2019 level (Chart), driven by key manufacturing economies like China, Singapore and South Korea. Indeed, robust global demand for electronics and semiconductors saw developing Asia’s growth momentum remain strong during H1 2024, despite sluggish consumption in China.

However, risks to the trade forecast are high. First, escalating conflict in the Middle East could further disrupt shipping and raise energy prices. Container shipping costs have eased in recent months but remain almost double the rate at end-2023, as rerouting around the Cape of Good Hope to avoid the Red Sea increases travel times significantly. Other trade routes could be impacted in a wider conflict. Further, while the oil market is expected to swing into surplus from 2025, a larger and prolonged war could raise oil prices and dampen economic growth in net oil-importing economies. Second, protectionism and trade fragmentation could increase. The number of discriminatory trade interventions has fallen only slightly since the record set in 2023 and trade between blocs of economies holding similar political views has grown 4% more slowly than trade within these blocs since the Ukraine war. The US election could result in higher tariffs on all US imports and a broad-based steep increase in tariffs on imports from China. This could significantly escalate China-US trade tensions, with negative spillovers to Asia.