© Export Finance Australia

The views expressed in World Risk Developments represent those of Export Finance Australia at the time of publication and are subject to change. They do not represent the views of the Australian Government. The information in this report is published for general information only and does not comprise advice or a recommendation of any kind. While Export Finance Australia endeavours to ensure this information is accurate and current at the time of publication, Export Finance Australia makes no representation or warranty as to its reliability, accuracy or completeness. To the maximum extent permitted by law, Export Finance Australia will not be liable to you or any other person for any loss or damage suffered or incurred by any person arising from any act, or failure to act, on the basis of any information or opinions contained in this report.

Hong Kong—New initiatives aim to spur economic growth

Hong Kong’s economy has felt the pinch from China’s ongoing slowdown (where GDP growth fell to an 18-month low of 4.6% year-over-year in Q3 2024) and heightened political tensions. The IMF forecasts growth of 3.2% this year, before slowing to 2.7%, on average, over the five years to 2029. Despite rising tourism, private consumption remains sluggish and the Hang Seng stock market is down more than 20% over the past five years, notwithstanding a recent surge on the back of Chinese stimulus measures.

Hong Kong authorities recently announced new measures to stimulate the economy. Duties on liquor will be slashed to 10% from 100% to boost liquor trade and development of high value-added industries including logistics, storage, tourism and high-end food and beverage consumption. In financial services, the government aims to boost Hong Kong’s standing as an international trading centre for gold by building more gold storage facilities and accelerating the development of related businesses, such as trading, insurance and logistics.

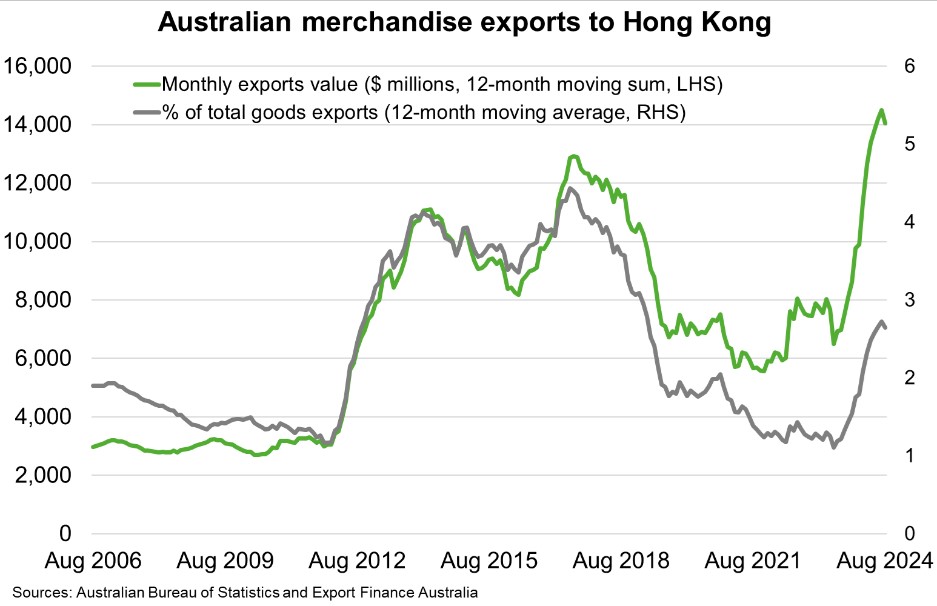

Despite recent economic challenges, Australian goods exports to Hong Kong—Australia’s 13th largest export market—have surged to a record $14 billion in the year to August 2024 (Chart). This gain in part reflects higher export volumes and prices for Australian gold and increasing demand for Australian wine. Still, Hong Kong accounts for just 2.5% of Australia’s total good exports, well down from a peak of 4.4% in mid-2017, highlighting the relative growth of Australian exports to other markets. Looking ahead, measures to spur Hong Kong’s domestic consumption and develop the gold sector are positive for Australian food, beverage and gold producers. This is balanced against prospects for a prolonged slowdown in China’s economy that raises risks to Hong Kong’s growth and threatens the rising trend of Australian goods exports.