© Export Finance Australia

The views expressed in World Risk Developments represent those of Export Finance Australia at the time of publication and are subject to change. They do not represent the views of the Australian Government. The information in this report is published for general information only and does not comprise advice or a recommendation of any kind. While Export Finance Australia endeavours to ensure this information is accurate and current at the time of publication, Export Finance Australia makes no representation or warranty as to its reliability, accuracy or completeness. To the maximum extent permitted by law, Export Finance Australia will not be liable to you or any other person for any loss or damage suffered or incurred by any person arising from any act, or failure to act, on the basis of any information or opinions contained in this report.

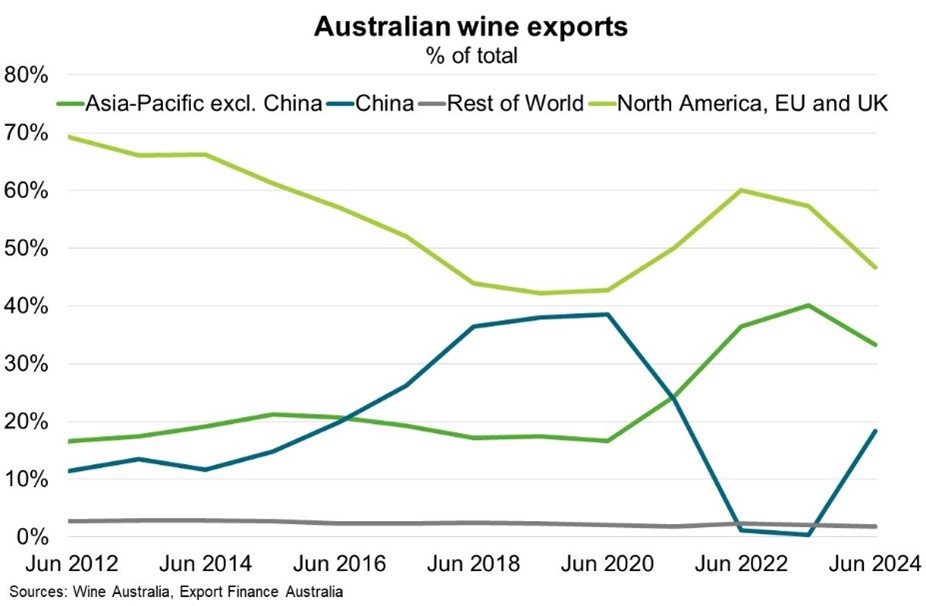

Australia—Wine exports rise as markets diversify beyond China

Renewed market access to China is driving a recovery in wine exports. Following the removal of Chinese restrictions on Australian bottled wine in late March, wine exports to China reached $392 million in the three months to June—more than seven times the value of wine exports to China over 2021 to 2023 combined. Volume grew from 1 million litres in FY2023 to 33 million litres in FY2024. The reopened Chinese market creates significant opportunities for high-end premium Australian wines that serve Chinese demand. The Department of Agriculture forecasts total wine exports to grow 5% in FY2025 to $2.4 billion.

But wine exports to China face challenges reaching peak pre-tariff levels of $1.1 billion in FY2020. China’s import market for wine has more than halved in recent years, reflecting reduced wine consumption, particularly in business-related events, and competition from other alcoholic beverages, such as spirits. In a smaller Chinese wine market, Australian exporters face intensifying competition from other global winemakers. Traditional markets in the US, EU and UK are likely to remain important for lower priced wines from Australia’s inland regions. But those markets too face ongoing pressure on disposable incomes and a shift in consumer preferences towards other beverages.

That makes it important for Australian winemakers to continue diversifying export markets, particularly toward fast growing economies in the Asia-Pacific. The share of Australian wine exports sent to the Asia-Pacific region, excluding China, rose to 33% in June 2024 from 17% in June 2020 (Chart). Australian wine is well-placed to take advantage of rising incomes in the region given geographical proximity and well-established business links. A growing focus on premium and niche wines (such as organic wines)—as global consumers choose to drink less but pay more—can help make Australian products more competitive in the global wine market.