Asia—Elevated B2B payment delays indicate business stress

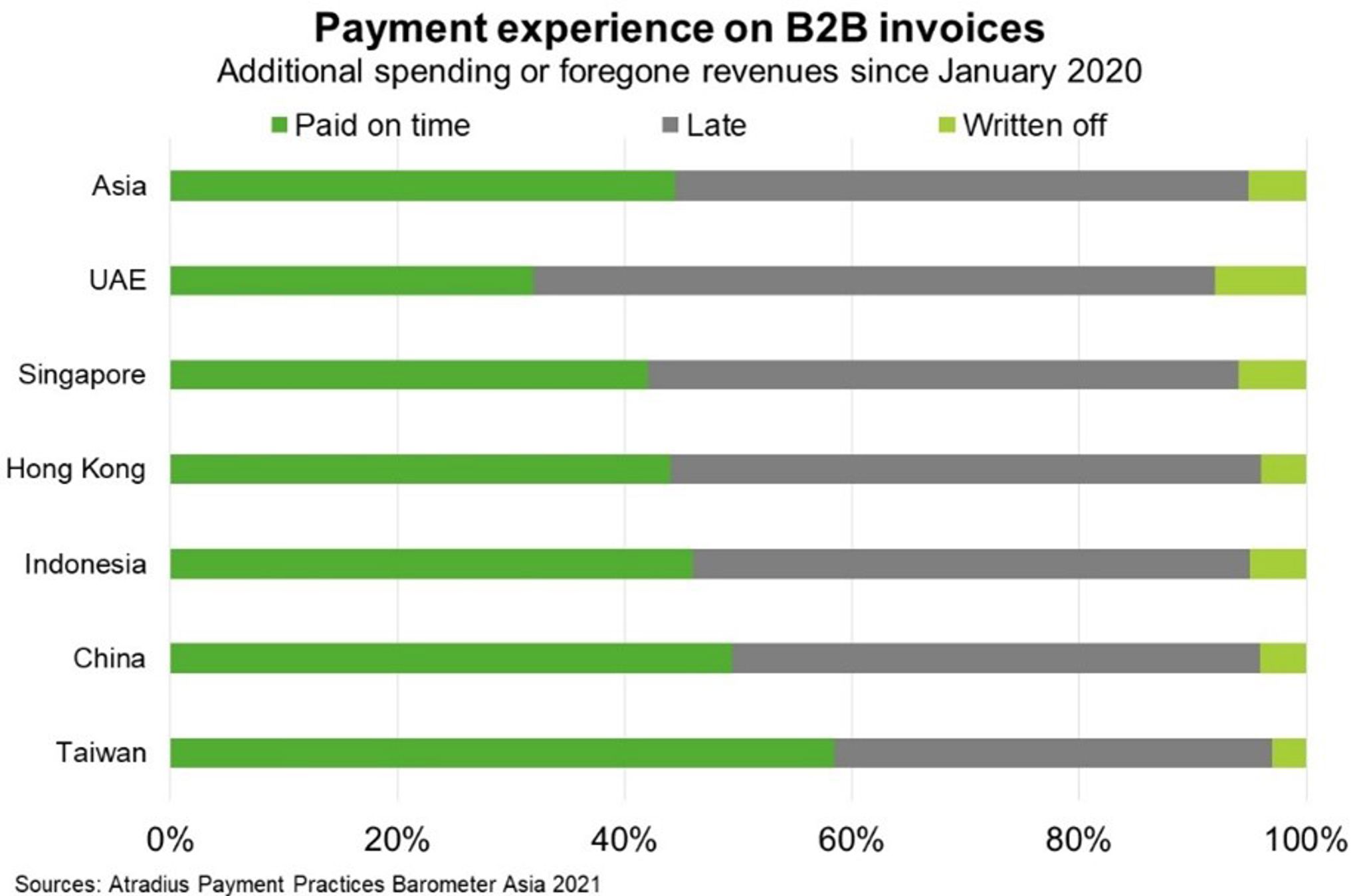

Despite robust global economic momentum, the Atradius Payment Practices Barometer suggests that 50% of all business to business (B2B) credit sales in Asia were overdue in Q2 2021 (Chart). While a minor improvement from polls conducted at the height of the COVID-19 pandemic last year (52%), it indicates that businesses face continued stress. Overall, 40% of respondents reported a deterioration in their customers’ payment practices over the past year, while just 10% reported an improvement. Almost half reported increased time, costs and resources spent on chasing overdue invoices, while 39% delayed payment to their own suppliers (with UAE the highest at 47%)—essentially transferring the problem up the supply chain.

Looking forward, a quarter of businesses expressed concern about maintaining adequate cash flow in coming months—with Singapore the highest at 32% followed by China at 31%. Indeed, recent COVID-19 outbreaks and the lagging vaccine rollout will weigh on Asia’s domestic demand prospects. While standout trade performance will continue to drive economic activity (merchandise export volumes were up 21% year on year in Asia in Q1 2021), momentum may fade as the pandemic weighs on production capacity and consumers spend more on services. The withdrawal of fiscal packages and insolvency law amendments will also test the ability of companies in the region to maintain adequate cash flows.

Late payments create operational headaches for businesses, making it more difficult to pay creditors and invest in critical inputs to complete new orders. Given 80% of Australian exports were sent to Asia last financial year, Australian SMEs should be alert to the risk of late payments from business customers in Asia and take steps to protect their businesses from insolvencies within their supply chains.