US—Debt limit uncertainty raises economic and fiscal risks

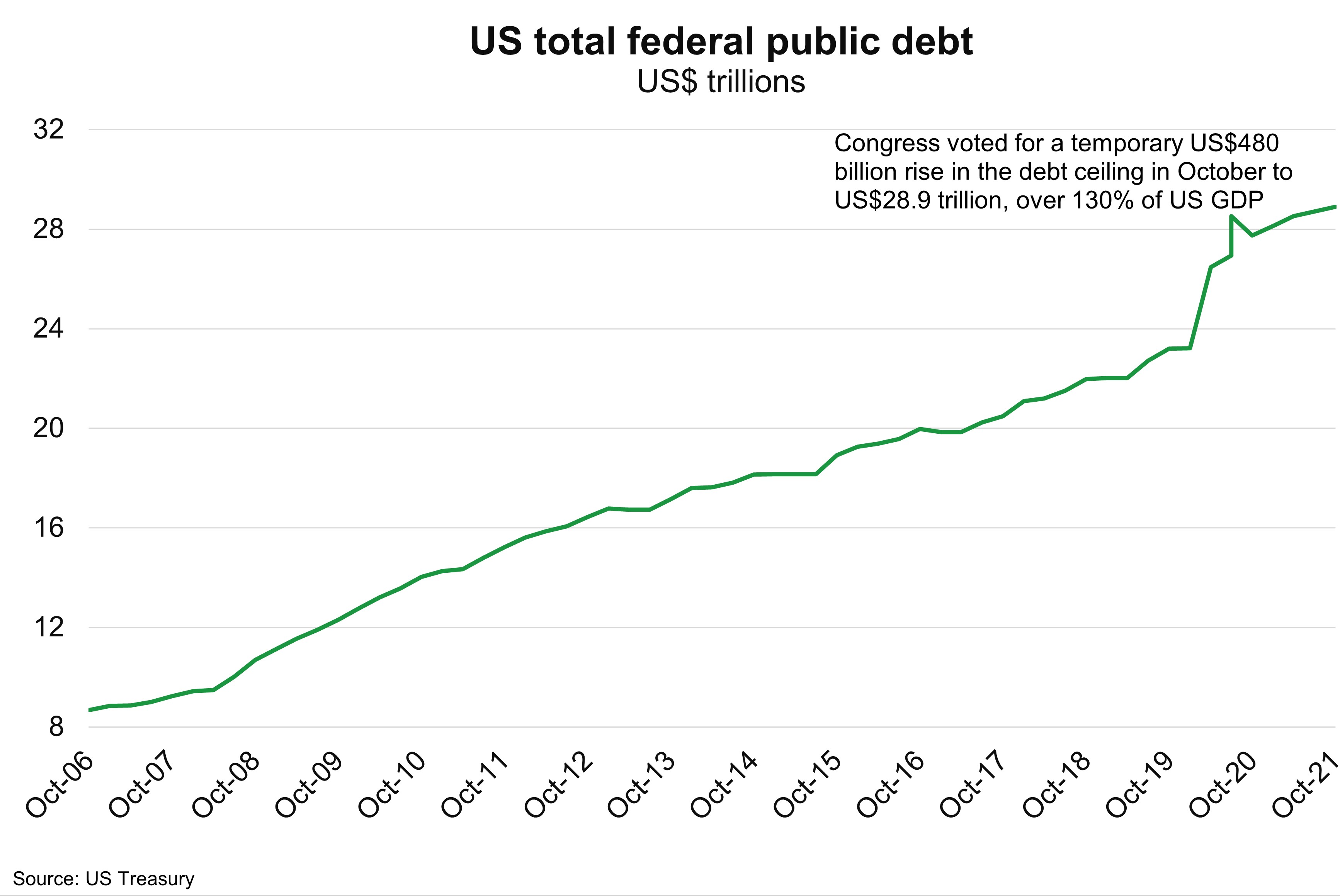

Congress approved legislation that temporarily raises the US government’s borrowing limit, averting an imminent government debt default in mid-October (Chart). The legislation supports government financing through to December 3, before Congress needs to vote again to raise or suspend the debt. The temporary stopgap also gives Democrats and Republicans more time to address political disagreements, particularly the size of the Democrats’ 10-year US$3.5 trillion “Build Back Better” spending proposals.

But debt limit uncertainty raises economic and fiscal risks. Stock markets were jittery prior to Congress’ latest legislative action. Without a debt-ceiling resolution, the government would be unable to make payments for social security, civil servant salaries and tax refunds, reducing household and business incomes and denting consumption and investment. Should debt service payments be missed, potential US sovereign credit downgrades would raise Treasury bond yields, as investors demand higher interest rates to compensate for increased repayment risk. That, in turn, would raise interest rates for credit cards, car loans and mortgages that are benchmarked against US Treasury rates, further hitting consumer demand.

Such an adverse scenario is a very low probability. The debt ceiling has been lifted more than 100 times since 1939 to allow the government to increase borrowing. The US has always paid its bills on time. But the impact of a prolonged debt ceiling impasse would be highly negative for both the US and global economies. In a downside scenario, a study by Moody’s Analytics found that the US economy (Australia’s third largest export market) could lose up to 6 million jobs, household wealth could fall by US$15 trillion and the unemployment rate could surge to roughly 9% from around 5% until the impasse is resolved.