World—Strong economic momentum slips while uncertainty rises

The IMF expects the global economy to expand a solid 5.9% this year and 4.9% next year. This is despite supply disruptions in advanced economies and worsening pandemic dynamics in developing countries which drove a small downgrade to the 2021 forecast. Meanwhile, international trade is booming; the IMF forecast world trade volumes to expand 9.7% in 2021 and 6.7% in 2022.

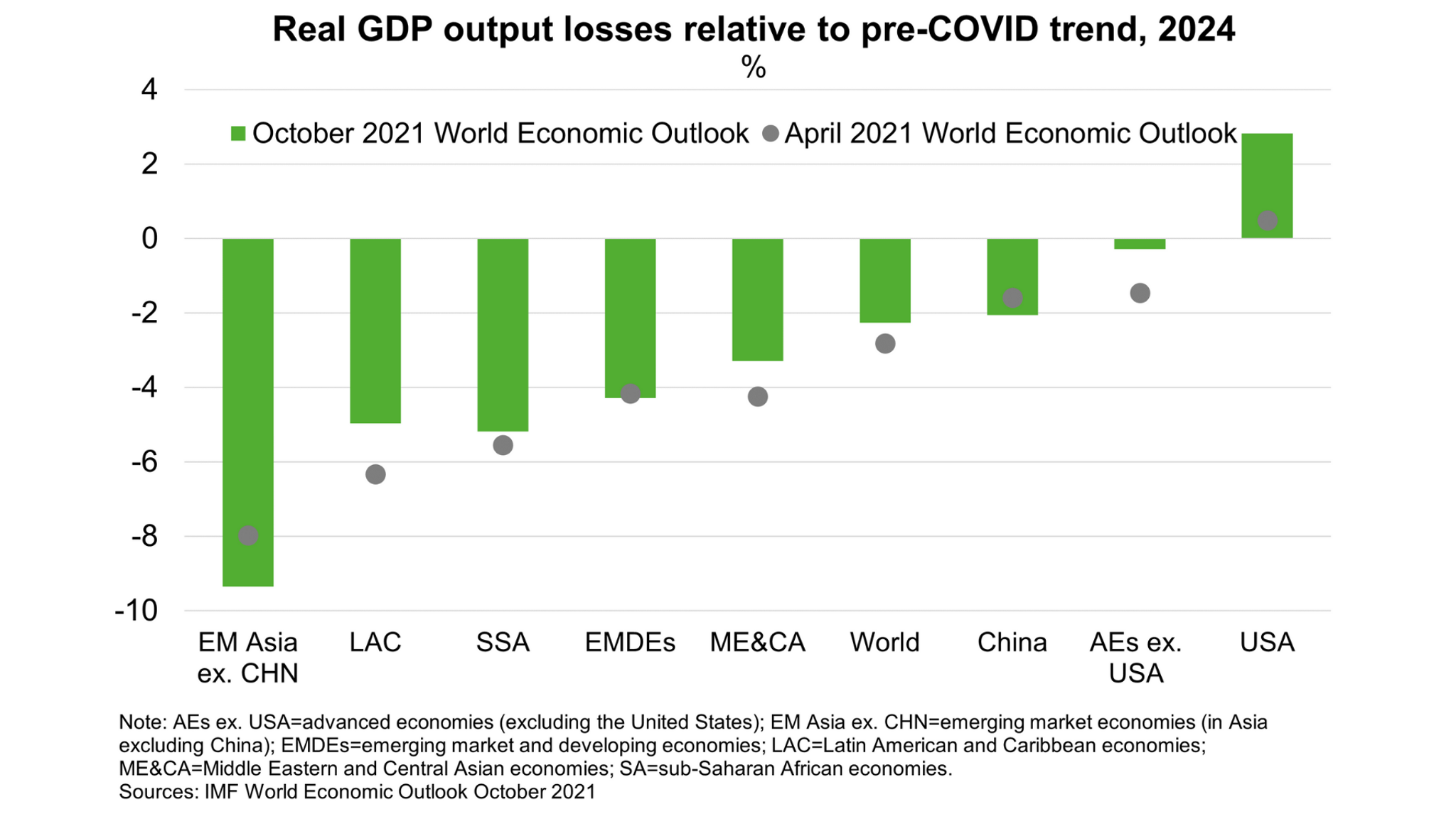

But economic scarring is expected to be pervasive. The biggest losses are expected for emerging markets in Asia (excluding China)—with output forecast to be 9.4% lower in 2024 than forecast in January 2020 (Chart). By contrast, output is predicted to be 2% lower for China and just 0.3% lower for advanced economies outside the US. Divergences owe to lopsided vaccine distribution and policy support. Almost 60% of the population in advanced economies are fully vaccinated against just 4% in low-income countries. The capacity of low-income countries to provide fiscal stimulus is also strained by higher interest rates and lower government revenues. Australia’s export profile is relatively well placed; 86% of Australian exports last year were to countries expected to see smaller than average output losses.

The IMF warn that economic prospects are increasingly unpredictable and likely to disappoint. New variants that are more transmissible, deadlier or vaccine-evading could derail the assumption that COVID-19 deaths are brought to low levels everywhere by end-2022. More persistent supply-demand mismatches and spiking energy and food prices could derail the assumption that price pressures will subside in most countries next year. Stretched asset valuations could cause financial market volatility if investor sentiment deteriorates. While the pace of vaccine distribution and productivity growth may surprise on the upside, the risk of mounting social unrest, climate shocks, cyber-attacks and trade tensions also weigh on the outlook.