China—Growth moderates as COVID-19 challenges loom

Strong industrial output and export performance propelled China’s strong GDP growth of 8.1% in 2021, after a COVID-induced downturn in 2020. However, growth slowed in the final quarter of 2021 and remains weaker than pre-COVID rates. Looking ahead, weaker demand for Chinese exports is likely as the world dials back fiscal stimulus and shifts toward services spending, although Chinese manufacturers may benefit from a weaker local currency if US interest rates rise sharply. Meanwhile, a strict COVID-19 policy and recurrent mobility restrictions will continue to weigh on consumer confidence and private consumption in China. In combination with retrenchment in the property sector under the government’s continuing deleveraging efforts, the IMF revised down its 2022 growth forecast by 0.8 ppts relative to October, to 4.8% (sharply lower than average growth of 7.7% p.a. over the decade to 2019).

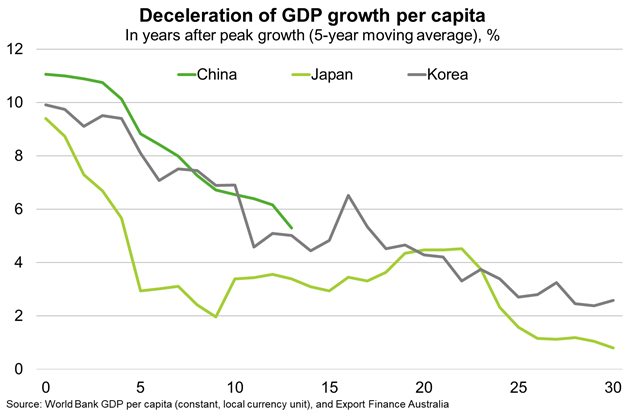

Research by the RBA suggests China’s economy is likely to continue to slow for another decade. GDP growth can be rapid in lower income countries because the scientific, technological and knowledge frontier is far ahead of where the country starts. However, statistical analysis of historical global growth trends suggests this rapid growth rarely lasts once developing economies mature, meaning strong ‘regression to the mean’ is likely. As a result, China’s economic growth may follow a similar path to Japan and Korea (Chart).

China’s economic performance is important for global prospects. Aside from being Australia’s largest export market (comprising 39% of merchandise exports in 2021), China accounts for a quarter of projected global GDP growth in 2021-23 and around 12.5% of world trade. Further moderating in China’s economy will disproportionately hit many resources exporters. For instance, lower Chinese steel output contributed to iron ore prices retreating 60% from highs in 2021 (with a limited recent recovery). China’s strict zero-COVID policy may also create supply bottlenecks. For example, a 10% rise in China’s export prices caused by supply problems could lower global GDP growth by 0.7 ppts p.a. and raise global inflation by 0.4 ppts p.a., according to the OECD.