Latin America—Slowing growth and high inflation fuel social tensions

A post-pandemic services boom boosted by a commodity price spike supported Latin American (LatAm) economies last year. But the region is expected to experience a sharp deceleration this year—the IMF forecast GDP growth to slow to 1.8% in 2023 and 2.1% in 2024, down from 3.9% in 2022. Meanwhile, despite the early and steadfast efforts of LatAm central banks and lower global food and energy prices, bringing core inflation (that is, excluding food and energy) back down to target will likely be a protracted process subject to risks. Slowing growth and high inflation, particularly amid a weaker and more uncertain global backdrop, will weigh on living standards in a number of Australia’s largest LatAm export markets—Brazil, Chile, Argentina and Colombia ($6.4 billion of Australian goods and services exports in FY2022). Although, ‘nearshoring’ (relocating production closer to end markets, particularly in the US) efforts to some countries, for example in Mexico, may provide opportunities for Australian exports.

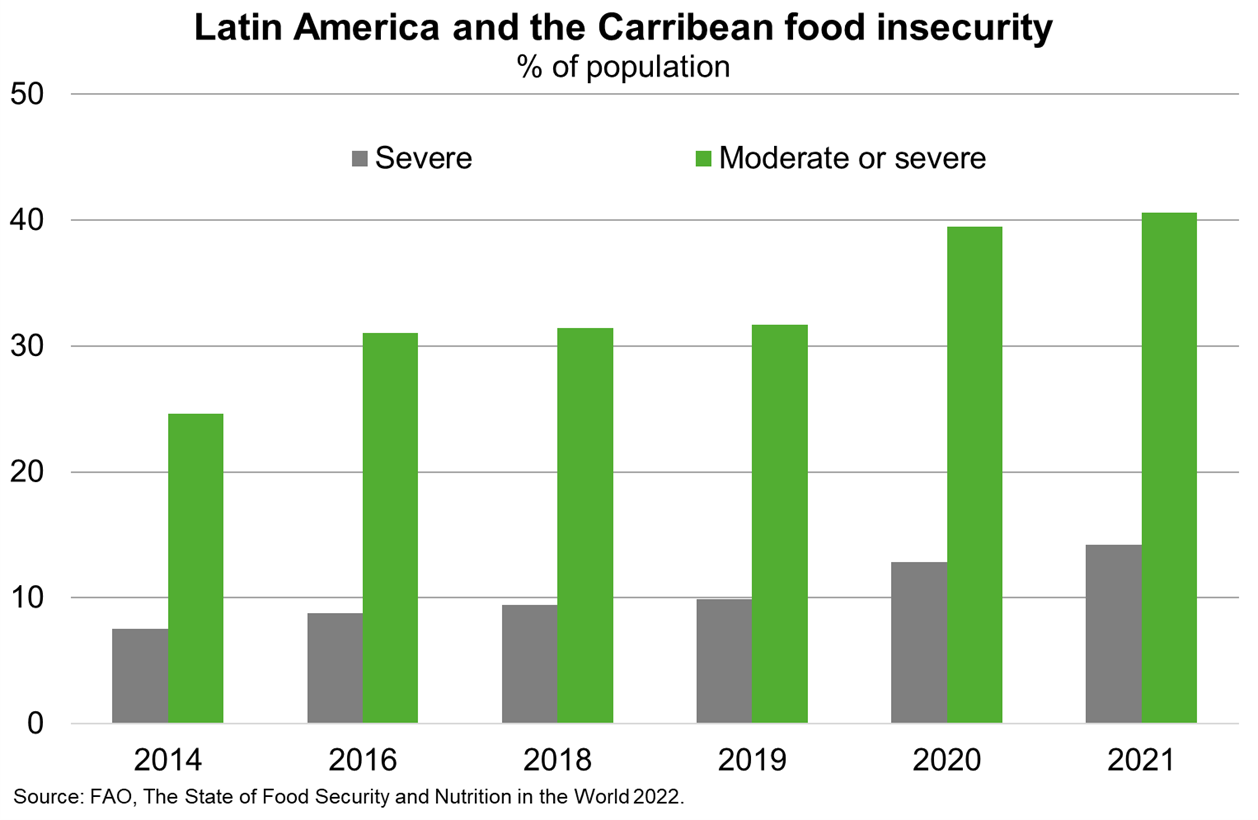

LatAm has long suffered growing social discontent and diminished trust in public institutions. Social tensions were exacerbated during the pandemic, as food insecurity (Chart) and poverty increased. High anti-government sentiment and popular demand for fiscal expansion saw a collapse in electoral support for the moderate center, and the return of left-wing parties to government, during a series of elections in 2021-22. However, honeymoon periods were short. Stagflationary economic conditions will exacerbate governability challenges and raise the risk of widespread violent protests akin to those in 2019. Particularly given stretched public finances that limit the scope of government support.