Australia—Multilateralism supports exports, despite Chinese distortions

A destructive acceleration of protectionism amid the COVID-19 economic and health crisis has so far been avoided, according to the World Trade Organization. Since the pandemic’s onset, G-20 economies have implemented 140 goods trade-related measures, of which 101 were trade facilitating and 39 were trade restrictive. By mid-May 2021, 22% of COVID-19 trade facilitating measures were rescinded compared with 49% of trade restrictive measures.

Limiting of global trade restrictions contrasts with significant Chinese barriers on Australian goods exports, including barley, beef, cotton, wine, lobsters, timber logs, and coal. China’s government has also warned its population about visiting and studying in Australia. The impact on each industry will depend on a) their reliance on the Chinese market, b) how easily they can divert to alternative markets, and c) the prices received in these markets.

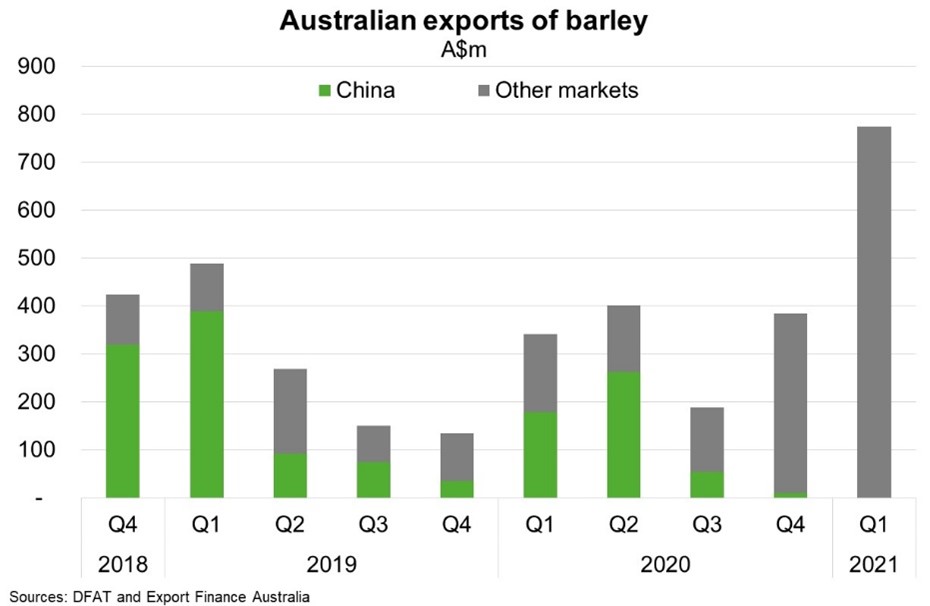

China was Australia’s largest export market for barley, wood and cotton (over 50% of exports from 2018 to 2020) and alcoholic beverages (30% of exports). China was Australia’s second and third largest export market for coal and beef respectively (each 20%). For some of these products, exports to China have effectively ceased. However, China’s increased demand for non‑Australian globally traded commodities has created opportunities for Australian exporters in other markets. For instance, the Productivity Commission notes that barley exports to Saudi Arabia and Asia have increased, and a trial is underway selling premium malting barley to Mexico (Chart). Similarly, new customers for coal were found in Japan, India, Pakistan and the Middle East. But the transition takes longer and costs more for less substitutable products. For instance, tailoring wine to the tastes of new consumers requires time and investment. Indeed, wine exports are forecast to fall to $2.3 billion in FY2022 from a peak of $3 billion in FY2019.