The US Federal Reserve’s recent announcement that interest rate hikes could come as early as 2023, relative to previous estimates of 2024, has raised concerns about economic recoveries in Asia. Investors fear a repeat of the “taper-tantrum” period in 2013, when US monetary tightening prompted large capital outflows from emerging Asia. If that episode occurred again, depreciation pressure on Asian currencies and higher imported inflation would likely prompt Asian central banks to raise interest rates in defence, and in turn, put economic recoveries at risk.

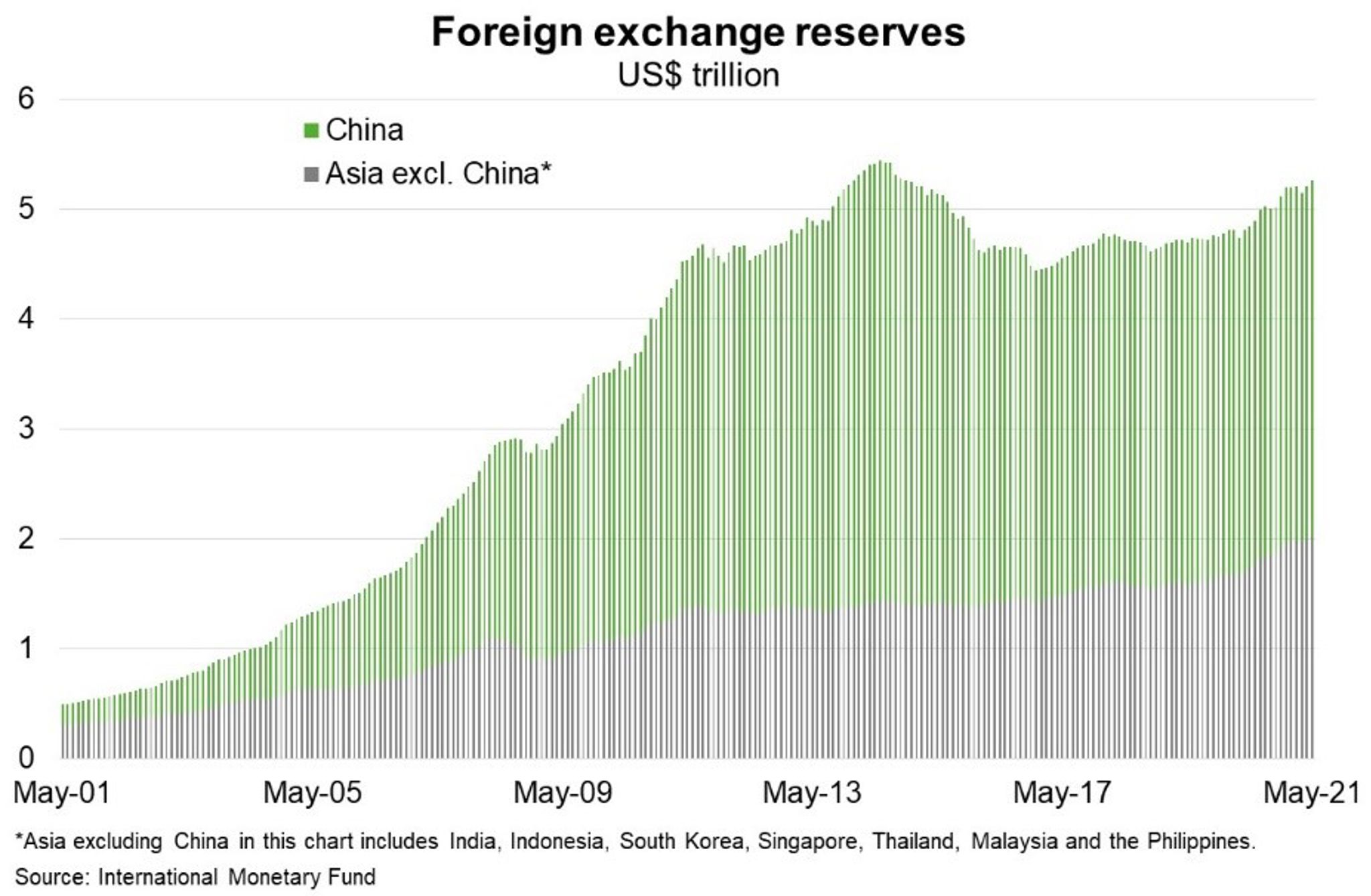

But unlike in 2013, the Federal Reserve’s sufficient forward guidance suggests a gradual and orderly unwinding of US monetary stimulus. Rising US interest rates ultimately reflect a stronger US economy, and is positive for continued growth in global trade. Further, emerging Asian economies have stronger economic fundamentals and financial buffers than in the past to mitigate risks from sudden and sharp shifts in capital flows. Asia’s robust export engines are likely to continue to benefit from rising global goods trade. The prospect of weaker currencies against the USD and Chinese yuan should also support export competitiveness. Meanwhile, inflation across Asia largely remains benign (outside of a few exceptions), removing the need for rate hikes as seen in other emerging markets, including Mexico, Brazil and Hungary. Foreign exchange (FX) reserves have been built to near record-high levels (Chart). This, alongside lower external indebtedness than in the past, means Asian central banks have greater room to divest FX assets to defend currencies or repay external debt without facing market pressure over financial stability. Asia’s likely resilience to a period of US monetary tightening is important given the region consumes more than 75% of Australian exports.