Philippines—Recovery fragile following largest recession in history

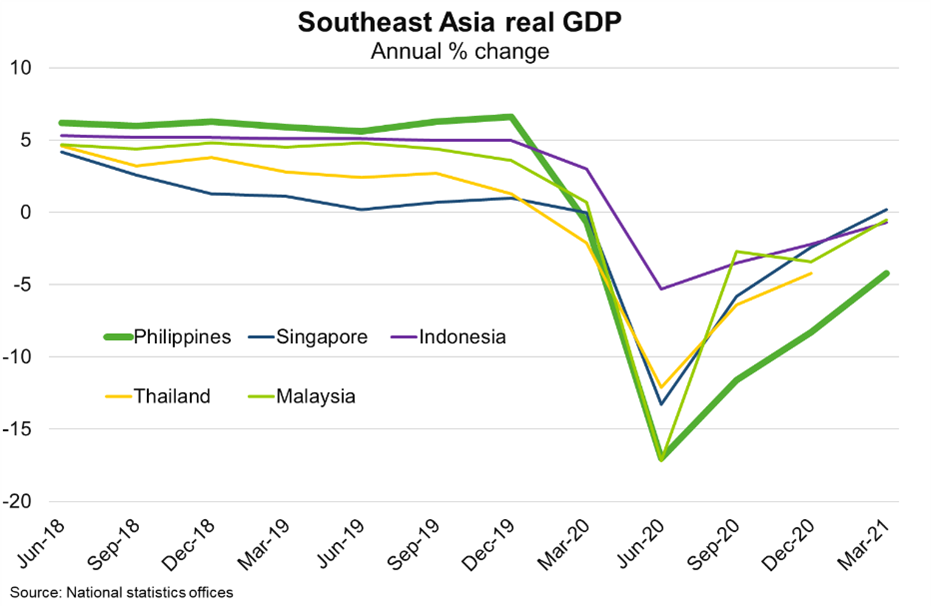

Challenges in controlling the spread of COVID-19 and slow progress on vaccinations means the Philippine recession has been more severe than for other large Southeast Asian economies and its recovery is likely to be more drawn-out (Chart). Following the recent round of containment measures in March, COVID-19 infections have begun to slow—to around 5,000 per day from as high as 15,000 in early April. But frequent lockdowns have hit business investment and consumer spending hard and contributed to the largest recession since records began in 1946. Real GDP fell 4.2% year-on-year in the first quarter of 2021, the fifth straight quarter of decline. Unlike in many export-oriented Asian economies, the Philippines' exposure to hard-hit services industries means exports are not recovering at the same pace as global trade. Before COVID-19, the Philippines was one of the fastest growing economies in Asia, with real GDP growth of 6.3% per year on average over the 10 years to 2019. But ongoing high infection rates could threaten the government’s goal of achieving at least 6.5% growth this year.

Longer term macroeconomic fundamentals remain sound, unless the Philippines faces damage to regional supply chains or a structural decline in remittances—which equate to about 9% of GDP and are a large driver of household incomes and consumption. A large and youthful population and the government’s ongoing commitment to enhancing the investment climate through increasing infrastructure spending should bolster growth potential. As the Philippines emerges from COVID-19, this provides opportunities to Australian exporters of personal protective equipment and vaccines, copper mining, electric vehicles, agriculture, construction, defence technology projects, education and renewable energy. Goods exports to the Philippines totalled $2.45 billion over the 12 months to March 2021, roughly $400 million off the highs reached in 2018-19.