Australia—Ukraine invasion weighs on non-resources export outlook

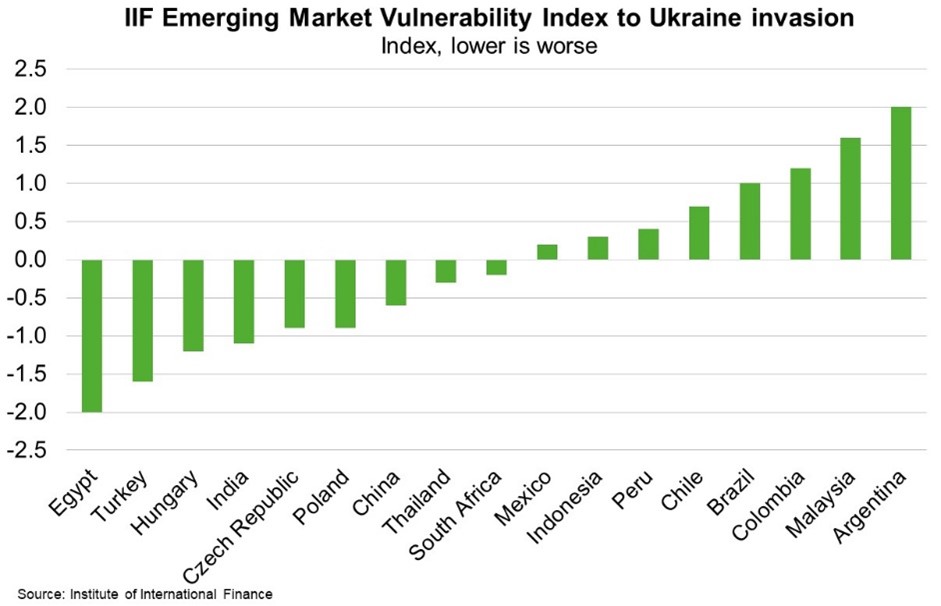

While Russia’s economy is only slightly larger than Australia’s economy, comprising just 1.7% of global GDP, the invasion of Ukraine is crimping global confidence and exacerbating concerns around inflation, given Russia is a major global resources supplier. The magnitude of the economic impact is highly uncertain and will depend on the duration of the conflict and policy responses. However, the OECD estimates that global GDP growth could be 110 basis points lower and consumer price inflation could be 250 basis points higher in the first year of the conflict. Renewed supply chain disruptions and soaring energy prices will weigh on Europe in particular, which relies on Russia for 40% of its natural gas. For emerging markets, the conflict raises risks for countries with substantial trade and investment links with Russia and Ukraine, and/or significant fuel and food import bills. An index published by the International Institute of Finance suggests Egypt, Turkey and Hungary are vulnerable, while China and India are also exposed (Chart). If the conflict escalates, a flight to safety could spark indiscriminate capital outflows.

Australian exports to Russia and Ukraine are small; combined two-way trade amounted to just 0.2% of Australia’s global trade in 2020. Russia ranks number one, two and three respectively for natural gas, oil and coal exports globally. It produces a tenth of the world’s nickel, aluminium and copper. Russia and Ukraine also account for 26% of global wheat exports and 14% of barley exports. Meanwhile, gold prices have been buoyed by haven flows. Australian exporters may benefit from sharply higher energy, metals and grains prices as Russian and Ukrainian supplies exit the market. Australia’s substantial exports of all these commodities suggests further upside to the AUD in the near term, though any gains would be tempered by investors’ risk aversion and higher US interest rates. But Australian imports, particularly of fuel, fertiliser, capital goods and consumer goods, could all rise in price, offsetting some of the gains for exporters. Non-resources exports may also continue to suffer from supply disruptions, higher transport costs, and any impact of weaker global demand and higher prices on household incomes and spending.