Emerging markets—Higher interest rates increase debt distress risks

The massive rise in debt levels in many emerging markets (EMs) has increased risks to debt sustainability and financial stability, particularly as global interest rates rise. According to the International Institute of Finance, global debt rose by US$10 trillion to a record US$303 trillion in 2021, with over 80% of the increase attributed to EM borrowing. While the pace of accumulation slowed in 2021, at 248% of GDP, the total EM debt-to-GDP ratio is still over 20 ppts higher than its pre-pandemic level. Further, some EM governments have become more reliant on off-budget borrowing to fuel the post-COVID recovery, raising contingent liability risks.

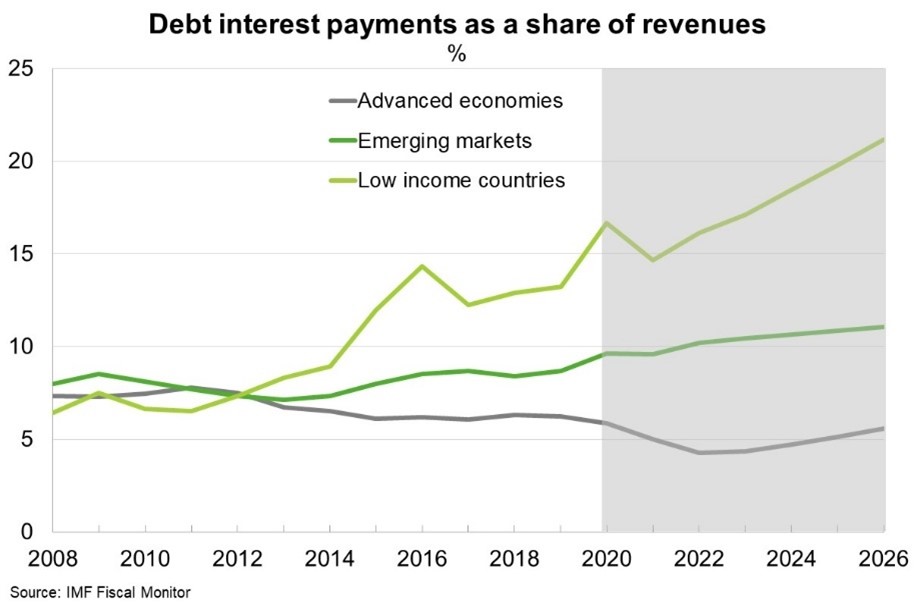

The US Federal Reserve delivered a 25 basis point rate hike this month and signalled it would move “expeditiously” towards higher borrowing costs to counter the economic risks posed by excessive inflation. Policymakers have raised their median expectations for the US federal funds rate to 1.9% in 2022 and 2.8% in 2023, from a range of 0.25–0.5% currently. Higher US interest rates increase the cost of meeting US dollar-denominated debt obligations, particularly for EMs that see large currency depreciations or have debt subject to variable interest rates. EMs are further entering the tightening cycle with record refinancing needs; some US$7 trillion of EM bonds and loans come due through end-2022, up from US$5.5 trillion in 2021. External debt servicing costs will rise particularly sharply for low-income countries (Chart).

Higher debt servicing costs may crowd out much-needed public expenditure on health, social services and infrastructure. As countries are required to borrow more to service outstanding debt and fund essential spending, sustainable debt levels may be breached. Some 60% of low-income countries are already in, or are at high risk of, debt distress, compared with 30% in 2015. Risks to indebted governments, firms and households threaten to stymie post-pandemic growth and make recoveries more uneven.